What are the Classic Options at IQ Option?

The Classic Options at IQ Option are a new product that launched in 2017 and it is an absolute novelty in the world of binary options brokerages. This product has a completely different way of trading binary options, so that the strategies and trades are also different. The only thing that remains the same is the platform, although there are more settings and choices for Classic Options at IQ Option, when compared with a regular binary options trade on IQ Option.

The Classic Options at IQ Option may seem a little complicated to understand at first glance, but after learning how they work, they are as simple to use as the binary options.

The Classic Options at IQ Option work with the stock options in the stock market for stocks whose annual business volume exceeds 1 trillion dollars. The advantage of the Classic Options at IQ Option in comparison with the purchase of stock in the markets is the possibility to buy options on expensive stocks and thus profit from stocks that you would normally not be able to buy any other way.

Check out the Classic Options at IQ Option for free

But then, what are the Classic Options at IQ Option?

First, we have to understand what Stock Options are and how they work.

An option on a stock is a contract that gives us a right to purchase or sell that stock without an obligation to actually purchase or sell the stock. In other words, it is a contract where we intend to buy or sell an asset in a given time period, and at the end of the term or during the duration of this contract we can end the contract. Thus, there are two kinds of Stock Options, Call (buy) or Put (sale), just like in Binary options.

Complicated? Here’s an example of a contract for an option on a stock:

Imagine a purchase contract (CALL) of shares of the company Apple.

Peter buys from John 100 Apple options contracts for $128 with an expiry date of December 30. At the time of purchase, the Apple shares are quoting at $138.

If on December 30, the stock is trading at $140, for example, Peter will exercise the purchase option and John will sell the Apple stock at the agreed value of $128. Since the share price is higher than the price agreed between them, Peter has an interest in exercising the purchase option and purchasing the stock at $128 because he can get an instant profit if he then sells the stock in the Market at the higher currently quoted price, which in our example is $140.

If on December 30, the value of the Apple stock has come down to $120, Peter has no interest in exercising the purchase option because it will be cheaper to buy the shares at the current market price than the price of the option contract which is $128. In this case, Peter loses the $128 agreed in the contract for not exercising the right.

Peter makes a profit when the price goes up, his loss is the $128 that was the value of the contract when he does not exercise the right.

Let’s see the video below that explains the Classic Options at IQ Option.

Classic Options at IQ Option – How they work:

The Classic Options at IQ Option were inspired by the American Stock Options. The value of the options is based on the stock prices of the 500 largest American companies (the S&P 500 index), like McDonalds, Netflix, Starbucks, Apple, Google and many others.

When we buy Classic Options at IQ Option, our maximum loss is the value of our trade, i.e. 100% of the amount invested. Our profit has no limit; it can range from 1% to 2,000%. In other words, we have a limit in the amount that we can lose, but the gains may be far above the values used in binary options. The earnings potential is much greater with Classic Options at IQ Option than with the normal binary options.

Profits in the Classic Options at IQ Option depend on the change in the price, the higher the price variation in our favor the greater profit potential.

The Classic Options at IQ Option use longer expiration times than those used in binary options. There is no 1- or 2-minute turbo mode. Usually the expiration times range from 1 hour to 1 week, and may well be longer.

The Classic Options at IQ Option can be closed at any time. Therefore, when the trade is profiting, we can take advantage of it and close the trade to keep this profit. That’s an advantage; we can work with the evolution of the price of the asset for the duration of the Classic Options at IQ Option and don’t have to wait until the time ends.

The Classic Options at IQ Option are available from Monday to Friday from 2:40 pm to 8:00 pm GMT.

Some of the companies that can be traded with Classic Options at IQ Option

Classic Options at IQ Option – Characteristics:

– There are two types of options: Call (up) or Put (down).

– Assets available for Classic Options at IQ Option: About 500 different stocks of the largest American companies are available.

– Expiration time: The duration of the option can vary from a few hours to several weeks.

-Pricing Calculations: in the Classic Options at IQ Option there are several factors that determine the price, such as the best market price of the underlying asset, the time remaining before expiration, volatility and the exercise price (levels that the trader thinks the price will go up or down before expiration).

– Strike Price: This is the price at which we want to buy an option. We can close the option at any time, whether with a profit or a loss. Usually we use it to our advantage and close the trade when we’re making a profit.

– Calculation of profits on Classic Options at IQ Option: The calculation varies whether the option is a Call or a Put. Call options (purchase) work like this: Expiration Price – Strike Price. Strike price is the price at which the option was purchased. Multiply it by the amount of options purchased. Example: We buy 10 Call options at a strike price of 100. At the time of expiration the price is 120. The calculation is: 120-100 = 20 x 10 = $200. This value is our profit.

For Put options, the calculation is the opposite: Strike Price minus the Expiration Price, multiplied by the number of options purchased.

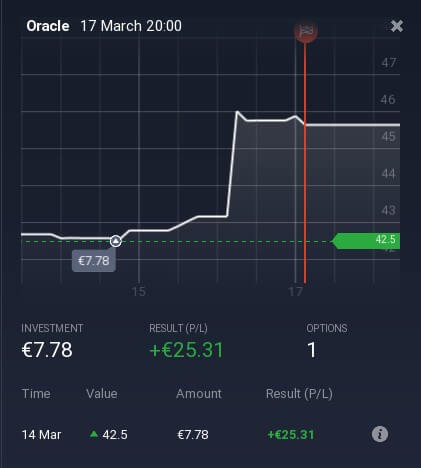

Example of a trade in my real account, with a small value. I bought Oracle on March 14 for €7.78 and sold it on March 16 for €33.09. The NET PROFIT was €25.31. This corresponds to a 325% profit in 2 days..

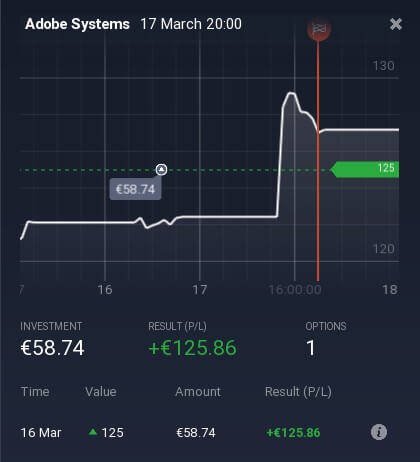

Another example. A profit of 214% in 1 day. I invested €58.74 in Adobe and in 24 hours I made €125.86, more than double what I invested.