Because Forex market moves several trillion dollars every day, many are the ones that look at it with deep enthusiasm regarding the possible profits. It is important to understand what Forex is and how you can trade, so go on, and read our article.

What is Forex?

- The Forex market is the largest financial market in value with daily transactions over 5 trillion dollars.

- The largest financial market in terms of the number of clients that trade daily.

- A market that is regulated and exists since 1971.

- Market related to the exchange alterations between the currencies of each country. In this financial instrument, we do not buy assets but trade the fluctuations/changes in value between two currencies.

- As explained above, the exchange market works with currency pairs, in which each asset is a combination of 2 different currencies, for example, EURUSD – which in this example is the pair composed by the Euro and the American Dollar.

- It works 24 hours a day, 5 days a week. The exchange market is open from Sunday night until Friday night.

The foreign exchange market or FOREX is the world’s largest market in terms of the amount of money traded every day, with more than 5 trillion dollars traded daily.

To get an idea of the size of the daily transactions, we can compare FOREX with the American stock market that trades about 250 billion USD compared to the more than 5 Trillion USD traded in the foreign exchange market.

All other markets combined, Exchanges, Binary Options, and others, do not have the daily volume that Forex has.

It is a market that works 24 hours a day, 5 days a week.

This allows a higher volume and more time for operations.

This increases the global volume and helps you to have more transactions, and therefore more profit.

Learn how the FOREX market works at IQ Option

Since 2004 the Forex market has registered exponential growth, due to the appearance of Online Brokers.

This was made possible by the appearance and development of a platform called MT4.

MT4 (Metatrader 4) has revolutionized the way of trading, offering customers a practical, simple and comprehensible platform.

Meta Trader 4 is nowadays used by a large share of Forex Brokers.

Its platform is available for Desktop, Android and IOS.

Today, as long as we have an Internet access we can be connected to the market.

We can trade anywhere and anytime on our account.

The MT4 platform is free and very light.

Is FOREX a fraud?

No, Forex is not fraud and we have seen that it is a regulated market.

But then why are there so many frauds linked to Forex?

In reality, the frauds and financial pyramids that have appeared in recent years only use the name Forex to look as if they were honest.

These financial pyramids that we hear about don’t even invest in this market.

They simply use people’s money to pay others and give confidence to new clients.

Then they simply disappear with people’s money.

They never invest in Forex.

That’s why Forex can be labeled a fraud, when in fact it ends up being a victim of the earning potential that it offers.

How do you trade in FOREX?

Forex trading involves the purchase of one currency and the simultaneous sale of another, that is, currencies are traded in pairs, for example, the Euro and the US dollar (EUR/USD). The investor doesn’t physically buy dollars or euros, but rather the monetary exchange relationship between them.

So, when someone makes a trade in this market they are not buying a particular currency, but a given PAIR, an exchange rate between the two currencies.

The operation is done through a purchase or sale order of the pair (e.g. EUR/USD).

If you enter to buy, you are betting on how the currency EURO will appreciate and the Dollar will depreciate, because the comparison is always made by the left currency.

On the contrary, if you enter for sale, you are betting that the currency EURO will devalue and the Dollar will value.

After choosing the asset, you have to choose the value. The platforms operate in lots, i.e., in quantity.

So, the operation is in quantity, for example you can buy or sell 0.01 lots, and not in value, because you do not buy $10 or $20, but a portion of a lot.

After choosing the asset and the quantity to trade, click to open an order. After opening it, it is advised to put a price like Take Profit which is the value you think the market will evolve and by establishing this value, you establish your gain value you want to have with that operation.

The opposite is also valid, which is to establish the maximum loss value you want to have. This value, called Stop Loss, leads to many discussions because many traders nowadays prefer not to use it, because they say that the market always oscillates and all orders when well placed, end up giving a profit.

With the fluctuation of the rates and the relative value between the currencies, different investment strategies, which can result in profits or losses, can be structured.

Typically, exchange rates do not vary dramatically in a short time, which should raise doubts about the veracity of the promises of high profitability that often accompany the foreign exchange market investment offers.

Download several useful files totally free here: FREE MATERIAL

Then how is it possible to have high profits in this market?

The answer is in using a margin account to trade. A margin account is essentially a short-term loan taken by the investor from the Forex brokers.

Since the trade is settled only with the difference between the values of the different currencies, it is not necessary that the investor has the entire amount of the trade available in the account.

For FOREX trading you can effectively deposit just a portion of the amount to cover the daily variations in the currency pairs.

Margin accounts give the investor more power to trade; an investor can place larger trades. Most of the foreign exchange market brokers use a 100:1 margin, which can go up to 1000:1.

Or deposit only $100 if the margin is 1000:1.

This structure allows greater profits, BUT IT ALSO ALLOWS GREATER LOSSES. The logic is the same, in fact, because the value that you can negotiate with a particular investment is multiplied, so too are the positive and negative results. In this sense, the ideal is to always use only a small part of the available margin.

This way if there is a change in the market you are not subject to major losses.

How does FOREX work?

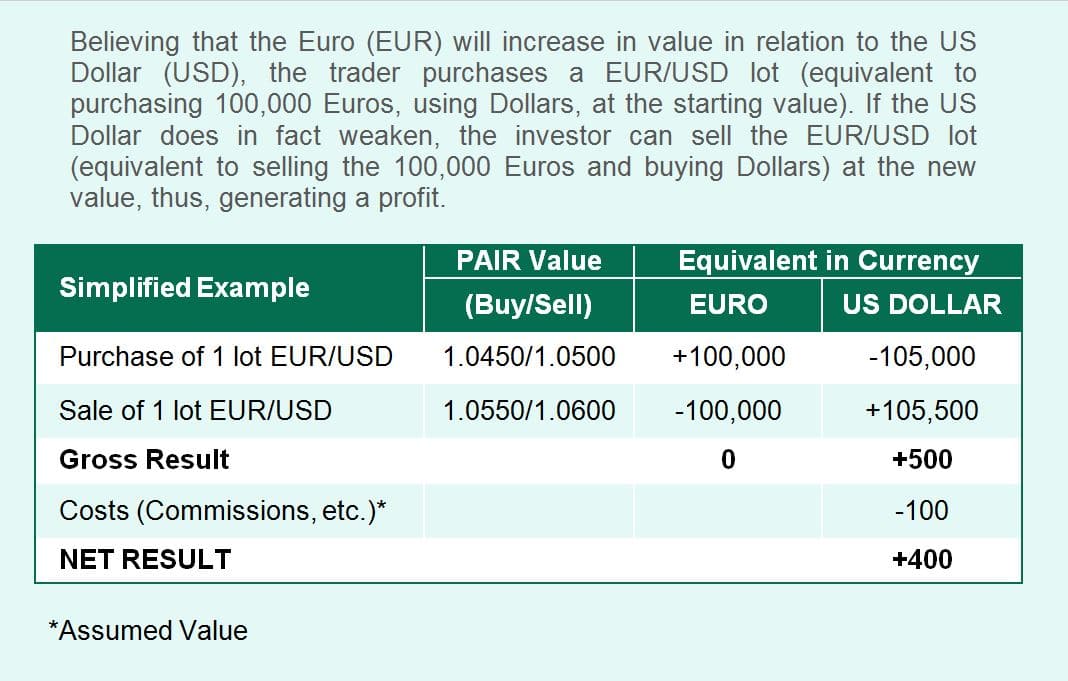

Let’s see an example of a FOREX operation with leverage.

In the example, if an investor had bought euros (1.0500), and then sold (1.0550) when they increased, he would have gotten a modest return (less than 0.5%, or $400 on $105 thousand).

In addition, it would have been necessary to pay $105,000. An amount that is out of the reach of the vast majority of individual investors.

However, with a margin trade, the investor could have invested much less. If the required margin is 0.5% or a ratio of 200:1, in the above example the trade of approximately $100 thousand could have been made with a deposit of just $500.

So, if an investor had to invest the entire value of the purchase of the currencies, and considering the variation between them, the gross result in the above example would be under 0.5%.

However, if the investor was able to purchase the EUR/USD pair with just $500, the result would represent a gross return of 80% in the same time period.

BUT THE LOSS COULD ALSO HAVE BEEN 80%. That is, if the value of the EURO had not risen, the $500 would have been reduced to $100, resulting in a loss of $400.

The FOREX market has a high potential for gains due to the use of leverage (margin), but you should always keep in mind that it is preferable to trade small lots (micro or mini lots), and thus have lower profits because this way you considerably reduce the risk in your account.

For those who have no interest or time to learn how to negotiate in this market, letting the management be done by a professional turns out to be an excellent solution.

You only pay when he presents results.

In practice it is not you who pays, but the profits generated by him who pay you for the work.

This way you can have interesting results.

Usually much higher than what is offered by term deposits and other more traditional investments.

What are FOREX Robots?

Automated systems, the so called EAs or Forex Robots, are becoming increasingly trendy.

With Forex Robots, everything is done automatically in your account.

This solution is one of the most used for those without knowledge.

Nowadays a big share of all the operations performed in this market are done entirely via these Forex Robots.

Know more about FOREX Robots.

FOREX Signals

Another tool widely used, especially for those who are new to FX and prefer to have a tool that helps to find the best operations, are the Signals.

Many of those that exist are very similar to Robots, but while the first ones do everything, in the account, that is, they look for the best trade and put it on the platform, the signals do not operate.

That is, the signals look for trades, but do not put them on the operation automatically.

They just warn the person, either by email, application or another way, that they have found a trade on a certain asset, whether it is for buy or sell and sometimes also say what is the best value for take profit and stop loss.

But it is the person who, ultimately, has the final decision to put the signal.

Check this link to know more about FOREX SIGNALS.

Brokers:

Brokers are the companies that provide you the possibility to trade in this market.

They usually offer the platforms and access to the foreign exchange market and have a corresponding regulation.

However not all brokers are like this.

It is important to understand the types of Forex brokers that exist and how each one works.

You should always take your time and investigate thoroughly when choosing the right broker for you.

Trading Platforms:

There are two types of platforms used in FX trading.

Metatrader 4 and 5 (MT4 and MT5), which in my opinion are the best platforms to trade in the FX market.

And the internal platforms that each broker uses.

Some brokers offer the two platform options.

Of the brokers with MT4 and MT5 platforms I highlight the ones I know best:

Brokers that offer their own platform are ideal for beginners because the operation of trading in their platforms is simpler.

In addition, they offer smaller deposits and the operations are calculated in a simpler way, than those on the MT4 and MT5 platform.

From this type of brokers I highlight the two that I know and that I personally like the most:

Is FOREX Safe?

The Forex market exists since 1971 and is a market regulated by several regulatory entities, some of which are among the most important worldwide.

However being safe should not be confused that it is guaranteed not to lose money.

All investments have risks and the exchange market, even by the leverage has even higher risks.

Therefore, it is a safe market because it is regulated, but not safe because it guarantees profits.

However, there are brokers that offer their services without regulation or with an exclusive regulation in offshore areas (tax havens).

Although not all of these Offshore Brokers are fraudulent, you must be careful.

One of the advantages of using a regulated Broker, for example in Europe, is that they have several mechanisms to defend their clients.

In addition, European regulated brokers have several obligations that serve to protect their clients’ money.

So yes, Forex is safe, if our broker is also safe.

When we say that Forex is secure, it doesn’t mean that you will make a profit.

Profits depend on how you will trade, or what tools you will use to obtain profits.

Forex or Binary Options which one to choose?

They are two distinct markets that work differently.

But they have one thing in common, the most used assets in Binary Options, are Forex assets.

Therefore, it is normal that you try one market, and end up trying the other.

About this topic I wrote my opinion of Binary Options vs Forex, regarding their differences and similarities.

In my opinion Binary Options are easier to understand for those who are new to this world of online trading and trading.

This is because Binary Options, are basically bets on the rise or fall of prices and the way of calculating profits is much simpler.

You can even try a free platform that offers both investment models, so it will be simple to test for free using a single platform and a single application.

Get to know IQ Option and test your Binary and Forex Options platform.

If you want to try an account with a Binary Options Broker for free, click on the Banner below and try a free demo account.

Here is a summary of what Forex is:

- A financial instrument with the highest turnover worldwide.

- Regulated internationally since 1971.

- We do not buy assets but trade in currency pairs.

- The investments are made in the exchange movements between 2 currencies.

- It is a leveraged market. The leverages can go up to 1:1000 or more.

- Leverage allows high yields, but higher risks.

- The best-known platform is Metatrader (MT4 and MT5).

FAQs Related to FOREX:

What is FOREX Market?

Forex or foreign exchange market is a regulated financial market where we do not buy any assets, but trade in the relationship of two currencies with each other. The so-called currency pairs. Trading works both ways, buy or sell, so we can bet on the decrease or increase in the value of one currency against the other currency of the pair. Example EUR/USD.

To know more click HERE.

How does FOREX Works?

This market operates 24 hours from Sunday night until Friday night, closing at the weekend. It is necessary to have an account on a platform and broker that offers this type of trading.

The operation is simple because its assets are always currency pairs and there are lots of them. See the example with EURUSD to understand how it works.

To learn more click HERE.

How to trade in FOREX market?

The forex transaction occurs by buying or selling a pair. After choosing the pair, you have to decide which currency will appreciate in the pair, and this determines whether to buy or sell. Then you choose the lot, because here we negotiate in quantity, being the base 1 lot. You must also determine what gain you want to have on the operation you are opening.

To know more click HERE.

What are brokers and which are the best?

Brokers are the companies that offer the trading platforms and the ones that enable you to act and trade in this market. Some attention is needed when choosing one because some are regulated and others are not.

To know more click HERE.

Is FOREX safe?

The exchange market has been regulated since 1971. That’s why it’s safe, however, you have to take several precautions, starting in the choice of the right broker, the way you will make a deposit, and of course, the way you will negotiate because being safe doesn’t mean it’s certain that you’ll make a profit.

To know more click HERE.

Read more about Forex here:

Wikipedia 2019 – Link

First website about Forex – LINK

Suggested Posts for You

- XTB – 20 Years in Business, How Good are They Now?

- X (Twitter) Scammers on Crypto

- Why Reflection in Crypto Might be the Next Trend of 2022?

- Which is the best Binary Options Broker?

- What’s the IQ Option APK and why choose it over the others?

- What is Staking in Cryptocurrency? Is it possible to earn crypto as a passive income?