In this in-depth comparison we will put the Binary vs Digital options. A face to face for you to understand what is the best financial instrument for you.

Key takeaways

- Binary options traders consider only the direction of the price — up or down — while digital options traders also consider how far the price moves from the pre-set strike price.

- Potential profitability for binary options on the IQ Option platform goes up to 95%, for digital options — up to 900%.

- Digital options have a higher risk-return ratio as compared to binary options.

- Binary options are potentially less profitable yet safer.

- Expiration periods for binary options range from 1 minute to 1 month, for digital options — 1 – 15 minutes.

- Binary traders can exploit small price movements, while digital options traders can exploit the big ones in a short period of time.

What do Binary and Digital Options Have in Common?

At IQ Option, one can trade two types of options: binary and digital. Both are a specific asset type called derivative — i.e., their value is intrinsically tied to the value of an underlying asset.

Buying or selling an option doesn’t mean you actually acquire the underlying asset. Instead, you speculate on whether the asset‘s price will go up or down over a certain period. Once the option expires, the deal gets closed automatically, and you either earn a profit denominated in percentage or lose your investment.

Let’s find out how these two types of options differ and which principles determine the outcome of the deals.

Binary vs Digital options: the Differences

Binary and digital options differ in three categories: events that determine the outcome of the trade, returns, and expiration periods.

- The outcome of the binary options trades depends on the direction of the price. That is, all you need to do is assume whether the price of the asset will go up or down, and if your forecast was correct, your deal is considered profitable. For digital options, it’s not only the direction of the price that matters but also the price distance from the opening price.

| Binary options: correctly guess whether the price will be higher or lower by the moment the trade expires → get profit Digital options: guess whether the price will be higher or lower → guess how far away it will be from the strike price by the moment the trade expires → get profit |

- The potential return for binary options at IQ Option can go as high as 95%. Your return on each trade is fixed and predetermined when you open a trade.

For example, you open a BUY option with an 87% expected profit — if the trade closes even slightly above the strike price, you get 87% of the invested amount.

A “Lower” binary options deal example. With $100 invested and an 87% expected profit, the price closed lower than the opening price (red line), which resulted in an $87 profit.

In the case of digital options, your potential return will fluctuate over the entire course of the deal: the further the price moves relative to the opening price, the higher the percentage of your profit or loss will be.

A “Lower” digital options deal example. The $100 investment yielded a 172% profit when the price closed lower than the selected strike price (red line).

With binary options trading, you can’t lose more than your investment amount. With digital options trading, however, your losses can exceed your initial investment — just like your profit could. The further away the price moves from your strike price, the higher your loss percentage.

- Expiration periods for binary options range from 1 minute to 1 month. Digital options’ expirations are limited to 1, 5, and 15 minutes.

Expiration Time for Binary Options

Expiration Time for Digital Options

| With binary options, it is most profitable to exploit small price movements. With digital ones, on the contrary, you can exploit big price movements in a short period of time. Both might be very profitable depending on the circumstances — just evaluate the situation and choose the right option type! |

How to Trade Binary Options on the IQ Option Platform

Log in to your IQ Option account and select an asset by clicking the + sign.

Choose “Binary” from the list and select the desired asset. IQ option offers over 20 assets in this category. You can filter the assets by price and recent profitability scores. View the full information on each asset, create alerts, or add to Watchlist by clicking the corresponding icons in front of the asset.

Choose the expiration time: from 1 minute to 1 month. Once the expiration time is over, the option will no longer be valid. The expiration time will be represented by a thick red vertical line on the chart.

Next, enter the investment amount.

Finally, analyze the chart and choose the expected price direction: Higher or Lower. You must open the trade before the purchase time expires. It is represented by the white line with the countdown timer. It’s possible to open several options at a time.

If your forecast turns out to be successful, you will earn a profit according to the expected profit percentage. Otherwise, you will lose the invested amount.

How to Trade Digital Options on the IQ Option Platform

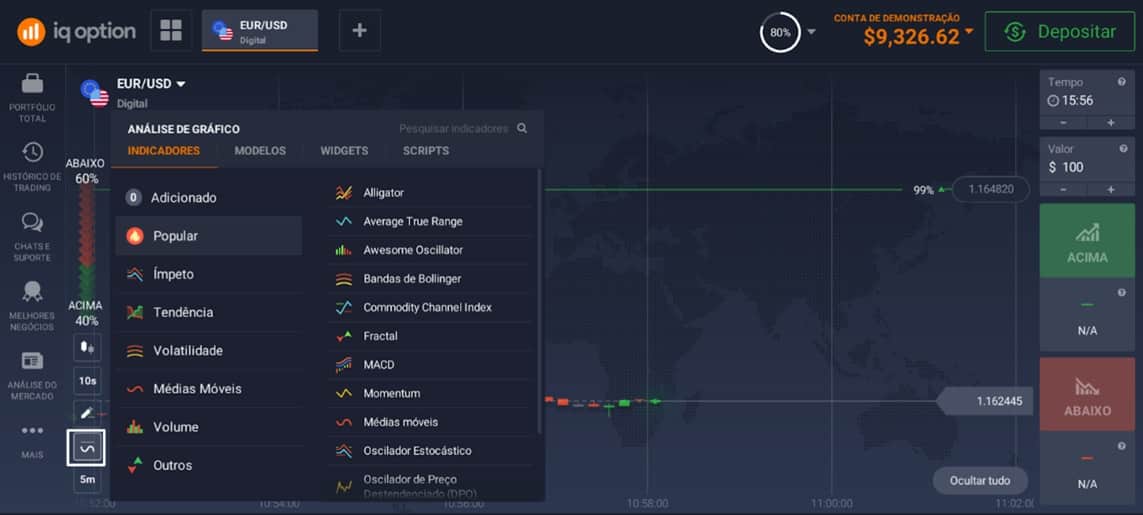

To open a digital options trade, click on the + button on the upper panel and select Digital from the Options tab. Then, choose an asset.

Now, select the strike price. This is the level that the price must go above (for the Higher options) or below (for the Lower options) for your deal to close in the money. Stike price levels are represented by white boxes on the left side of the chart. Hover over them, and you’ll see how the expected profit percentage changes. As the asset price pulls closer to the strike price, that option goes higher in value. To choose the desired strike price, just click on the corresponding white box.

| Unlike binary options, digital options’ profitability isn’t fixed: the percentage will be changing depending on the price action and can go as high as 900%. The higher the %, the lower your chances, and vice versa. |

To choose the optimal strike price, don’t forget to perform technical analysis. You can access over 100 technical indicators from the Indicators tab in the bottom left corner. Bollinger Bands are considered a strong analysis tool for digital options.

Now when you’ve made up your mind on the future price movement, select the expiration time (1,5, or 15 minutes), specify the invested amount, and press the green button if you believe the price will go above the chosen strike price or the red button if you think the price will end up below the strike price.

If the price expires outside of your strike level, you can sell your option before the expiry. To do that, click on the Sell button in the upper right corner.

Conclusion

Binary and digital options are very similar in general, yet a few distinctive features make a big difference. Binary options traders don’t care how far the price moves from the opening price — the only thing that matters is whether it ends up higher or lower. Digital options, on the contrary, consider not only the direction but also the price fluctuation magnitude. This allows traders to leverage a much bigger return of a very small investment yet increases risks.