Reflection in crypto allows the holders of a token to passively win more tokens, with no actions – such as staking – required.

Is Reflection in Crypto the Same as Staking?

The reflection concept emerged as an evolution of the staking mechanism.

Farming and staking took the blockchain by storm in the last year. It’s an appealing possibility, to be able to win passive income by simply ‘locking’ away some tokens for a period of time, thus generating interest.

However, in this system, some loss might occur, even if you are generating interest. We are talking about a very volatile market, and if the value of the underlying token changes dramatically – as it might – you will make less profit, than if you just retain/hold them.

In such volatile market, the reflection in crypto might help to lower the impact of said volatility. Simply because you win more tokens as the time goes by, after some time what you won in quantity helped to balance the eventual depreciation that the token could feel.

And that is why that we are seeing a booming of reflective tokenomics, which is called reflection.

As you will understand the reflection works in such way that it tries to discourage the early participants from dumping their tokens.

How does Reflection in Crypto Work?

Reflection works in a fairly simple way: every time there is a transaction, a fee is charged. That fee is then distributed among all token holders according to the percentage of assets they are holding.

This is done automatically, without the need from holder to stake anything. There is no action required from the holder.

The fees are awarded by use of smart contracts and are, in majority of cases, reflected immediately in the holder’s balance as (more) tokens of the same initial token.

The reflection in crypto is volume-dependent. This mechanism eases the negative sell pressure on the token caused by early holders liquidating their holdings. The mechanism also incentivizes holders to retain their tokens in order to earn larger returns that are proportional to the holder’s token holdings. The reflection system actually rewards the holders that keep their tokens the longest.

Some denote the reflection token as an RFI, because of the original DeFi project named Reflect Finance (RFI) that offers a small percentage of the transaction fees to all the holders of the token. It was the first project to use that mechanism.

Despite that, the project that has more reputation is probably SafeMoon (SAFEMOON), where a 10% fee is charged for all token transactions, with half of these fee’s collected automatically being redirected to existing token holders.

Other tokens are emerging quite fast, with similar mechanics, some examples being GLASS and GMR Finance.

The name reflection was suggested, most likely, because of this mechanics reflects in the holder’s balance immediately, with no redeeming necessary.

Reflection Tokenomic: the SafeMoon case

Let’s see the tokenomics of the SafeMoon token, to understand how this reflection in crypto can be put into practice.

SafeMoon charges 10%, to buy, sell or transfer. Half of that ‘tax’ is allocated to liquidity and the remaining half to the reflection’s mechanism.

As stated before, the percentage going to holders is shared equally between all holders according to their stake in the token. If you own 3% of the token for example, you will receive 3% of the amount redistributed to holders.

One of these holders is a ‘special holder’, since it’s a burn address. The burn address gets 41% of the 5% of reflection. That means that 2.05% are burn and the remaining 2.95% are distributed proportionately to all investors based on their current holdings.

A burn address is the final destination of any cryptocurrency token that is intentionally removed from circulation. They are unusable wallets and can’t be accessed or assigned to anyone.

The act of burning effectively removes tokens from the available supply, increasing its relative scarcity.

Please keep in mind, this example is referring to SafeMoon, other redistribution models exist.

Staking vs Reflection

There are 2 main differences between staking and reflection.

Necessity to allocate and move tokens:

In the staking system, you need to reserve some amount in some area/platform. Between the staking and the redeeming of the staking, there are, majority of times, fees. And those fees will cut your profit down, there is no running from it.

Reflection in crypto makes it in a automatic process, without the existence of additional fees.

Holding time

While positively affected by the reflection you don’t have any mandatory holding time. You get that cut as long as you’re holding the tokens. If you choose to sell those assets you can do it when you want.

But in staking, you frequently are obliged to keep the tokens for a mandatory time, with the penalty of a fee. Some projects might even stretch that penalty period for up to two years in which they are ‘locked’.

Let’s make a quick analogy with reflection in crypto and stocks holders.

While holding stocks you might win dividends regarding the profits that said company might have.

In a reflection tokenomics, your holdings will increase besides the eventual valorization of the token.

Why Reflection in Crypto Might Help?

Reflection tries to tackle several challenges.

Big players shaking up the market:

By stimulating the holders to keep their assets, it might Prevents whales from manipulation of markets and exploiting DeFi projects with low token supply.

Liquidity:

With a constant percentage of the tax fee returning to the liquidity pool, whether is selling or buying, the tokens will be mopped up to the liquidity pool, in order to establish a stable price floor for the token.

The penalty:

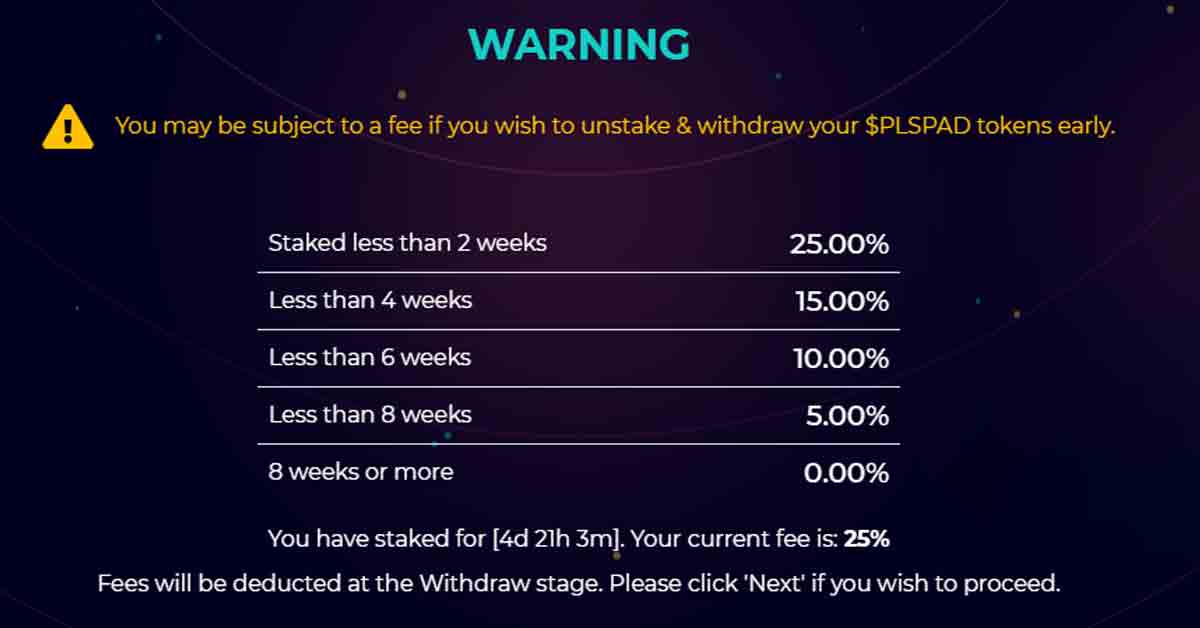

We mentioned the penalty function before and it can be seen as an arbitrage-resistant mechanism to ensure that the token’s volume remains stable as an incentive for holders. This discourages the holder from withdrawing the tokens before some amount of time.

The image bellow is self-explanatory, in which you can see the fees that a user has to pay if she/he wants to proceed with the withdraw.

Obviously, any investor will think twice before taking a hit of 25% by withdrawing in the first 2 weeks.

This is double-edged sword, though, as it depends highly in which side of the barricade you are.

Burn them to increase scarcity:

Lastly, the burn function, which serves to create scarcity resulting in a decrease in token supply.

Conclusion of the Reflection in Crypto:

Buying some tokens and waiting for them to grow, like a cake in the oven, that’s amazing, right?

At the time of writing these lines, the existence of reflection in crypto was a fairly recent activity.

In theory, it has a huge potential, not only to generate passive income with time, but also to create solid and stable projects throughout the time, with less manipulation of the market from the ‘whales’.

But we advise some caution since it’s all unproven. You should be in the lookout to detailed and feasible roadmaps, development teams that are true professionals in their areas and an overall solid project. And also, the lack of support might be a sign that this is a dubious development.

It’s not because there is reflection in crypto that the token will be a stable one. To prove that, we find several projects that used this mechanic and did not survived.

However, we are confident that the reflection in crypto we addressed in this article will trail the road in the next upcoming months, most likely bringing some amazing changes to the crypto scene, so enjoy the ride.