Blockchain and Bitcoin appear hand in hand. Let’s explain what Blockchain is and what its immeasurable potential is, which goes far beyond Bitcoin.

credits: Background vector created by rawpixel.com – www.freepik.com

What is the Blockchain?

If you have been dealing with cryptocurrencies, the term Blockchain is not completely foreign to you. But it might be a bit confusing, so we will help you clarify.

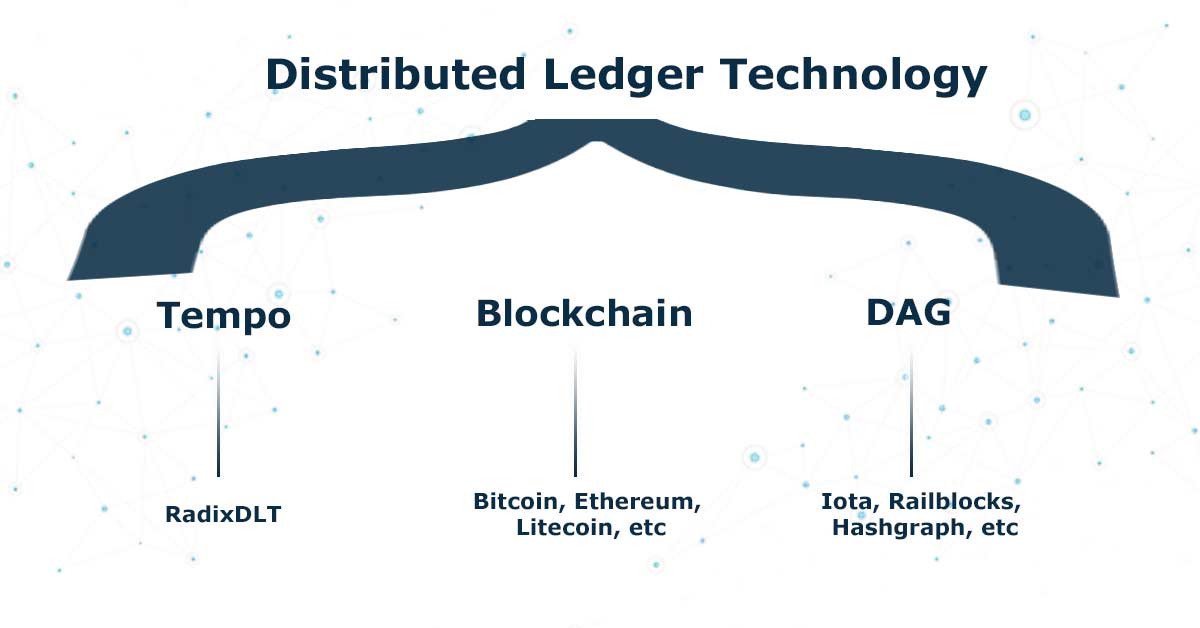

First it is important to explain that blockchain is a type of Distributed Ledger Technology.

The ledger, which has many other names depending on the area, is an absolutely essential document for recording and storing purchase/sale transactions, payments, contracts, movements, stock management, supply chains, etc.

To get to the present time, we have to go through 5,000 years of human evolution, where the centralized accounting system has remained dominant. Initially the information was recorded in clay, then on papyrus, then on paper, until we get to the computers of the 80s and 90s. During all these thousands of years, the accounting record has always been centralized. That is, in this model, there is always a central authority that controls the system. This can be a person, entity or company.

But everything can change, right?

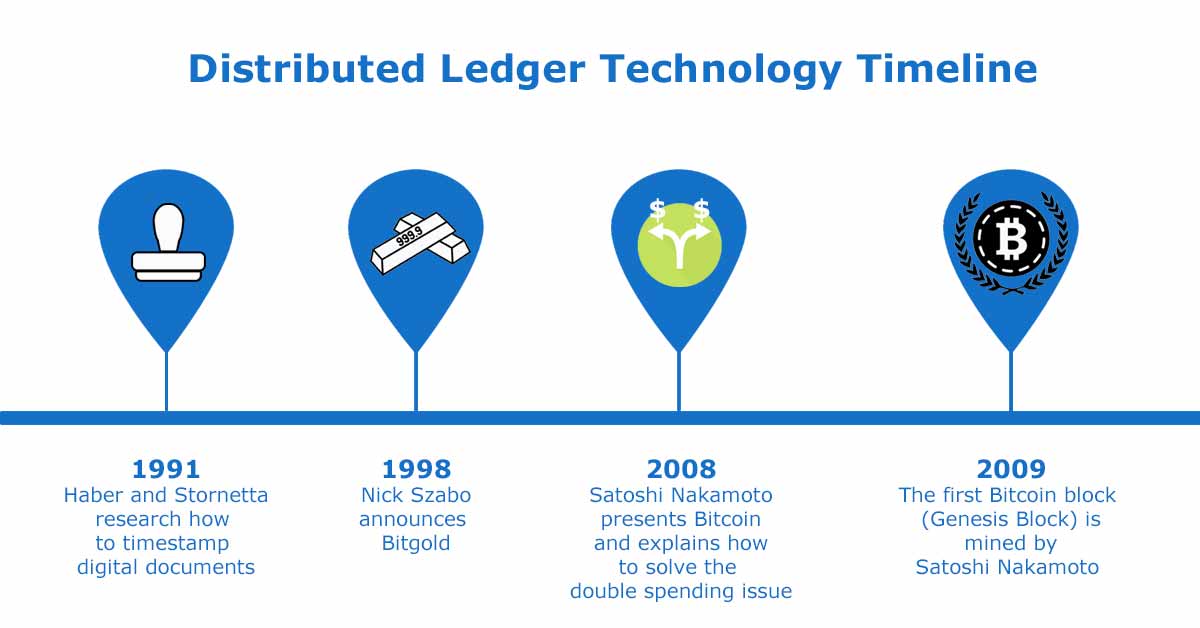

Then, during the early 2000s, a series of innovations to pre-existing concepts allowed the development of frameworks and protocols that stored data in blocks on a multi-user network. These attempts culminated in 2008 with the creation of the revolutionary document “Bitcoin: A Peer-to-Peer Electronic Cash System,” written by Satoshi Nakamoto, the pseudonym that created Bitcoin. In it, the creation of Bitcoin is proposed, where “funds” are transferred in peer-to-peer form. The underlying technology became coined as Blockchain, the first block appeared in January 2009, and the rest is history.

The first distributed, or decentralized, ledger was being created.

The image below exemplifies how Distributed Ledger Technology encompasses several decentralized database technologies, blockchain being one of them. Note that there are even more than the image shows.

The truth is that we haven’t even glimpsed all the potential that blockchain allows. One thing is certain, it is here to stay!

Take for example the following comparison. Just over 100 years ago the first automobiles were appearing. Their creators certainly never thought that their inventions could generate machines like the Bugatti Chiron or the Lamborghini Aventador. We are currently in the same situation, where we don’t know what blockchain will make possible 50 years from now, but it will be something epic and life-changing as we know it, surely.

Blockchain, the key concept

Although it sounds complicated, the core concept of blockchain is simple and can be described in a few words: it is a type of database, it records and stores data in blocks that are then linked together in chronological order. This chain of blocks (hence its name) is immutable and irreversible.

The devices that are part of the Bitcoin network are called nodes.

The blockchain is created and maintained by all the nodes that are part of the network, whether they are computers, laptops, digital wallets, or even cell phones. All of these thousands of nodes are participants and have an exact and transparent copy of all transaction history that is:

- Immutable

- Time-stamped

- Irreversible

- Unanimous

- Secure

- Confidential

Now that you understand the basic concept, I can dig a little deeper.

The first steps in developing blockchain were taken in 1991, when two researchers wanted to implement a system where the timestamps of documents could not be manipulated. But this technology that we now call blockchain did not have its first real-world implementation until almost 2 decades later, when Bitcoin was launched in January 2009.

Think of blockchain as a long chain of records. After a transaction occurs, the nodes that make up the network will verify its authenticity. After this verification, the transaction gets its timestamp, its unique identification (hash), and the hash of the previous transaction to which it is linked. The new block will join the end of the already existing long sequence of blocks, all temporally ordered, where it has the information stored, its hash and the hash of the previous block.

Want to see an example of a hash? Here you go: a8f5f167f44f4964e6c998dee827110c

Decentralization and Transparency, Two Key Points of this Technology

To better understand some of the basics of blockchain, let’s use Bitcoin as context to explain its implementation. For Bitcoin to exist, it requires a number of computers that will create and maintain the blockchain network. This database is distributed across several thousand computing nodes or devices.

But unlike most existing databases, the blockchain is not under one “roof” only, it is not centralized in any one entity. Each node is owned by a single individual, who replicates and saves an identical copy of each of the blocks. Each node participating in the network updates itself independently.

It is this characteristic of operating a network in a decentralized manner, without a central point of authority, that has made this technology one of the greatest revolutions of the modern era.

Instead of there being a central command that dictates the rules for the rest of the network, in Bitcoin’s blockchain there needs to be consensus and general authorization from all nodes.

I draw attention to the fact that other blockchains, of a private and centralized nature, also exist. However, these are not the blockchains where Bitcoin, Ethereum, Litecoin and most other cryptos run.

In the Bitcoin blockchain, every node has the complete record of all information recorded on the network since it was created. Even if the node joined the network yesterday, it will self-update with the complete history dating back to January 2009, that is, with the entire history of all Bitcoin transactions. Should an error occur on one of these nodes, it is easy for it to use the remaining thousands of nodes to self-correct. This constant checking and auditing process is independent and automatic, which takes this technology to a tremendous security level.

If someone tries to manipulate with the record of transactions in Bitcoin, all the nodes will cross-check data and compare with each other, and it is very easy to find the node that may have false or incorrect information.

In case a block is manipulated wrongly, it will be rejected by all other nodes in the network.

For a user to hack, tamper or manipulate data from a blockchain in order to be accepted by the network would require:

- have control of 51% or more of all the nodes in the network (it should be remembered that there are thousands)

- remake all the blocks in the chair that exist

- redo all the PoWs of every single block

In other words, it is something close to impossible.

Because of this decentralized nature, all the transactions made on the blockchain can be publicly consulted by everyone, simply by using explorers, such as the Bitcoin Blockchain Explorer. These explorers are search engines (imagine google) for querying transactions.

This general transparency nature is another highlight of the blockchain where Bitcoin runs.

Is Blockchain Secure and Reliable?

If you haven’t skipped the previous paragraphs, you already understand that we can talk about it being extremely secure. But because security is paramount, especially since the topic is our finances, let’s delve deeper into this chapter.

Double-spending and PoW

Since we are talking about digital money, and with no central oversight, annulling the problem of double-spending is absolutely essential. As you may understand, the whole system would collapse if you sent 10 units of any coin to Maria, then doubled it and sent another 10 units to Marc. Similarly, Maria would double her 10, and send 10 to Charles and 10 to Alice simultaneously. Such a coin would have no value at all, right?

All attempts to create digital money before Bitcoin (Bitgold was one example) floundered when trying to solve this big double-spending problem, but Bitcoin came up with an extremely ingenious and innovative solution.

The Proof of Work (PoW) was the solution found and is part of Bitcoin’s 2008 white paper, written by Satoshi Nakamoto.

Before a block is added to the blockchain, it goes through a validation process. Transactions are valid only when a candidate block actually becomes a confirmed block and becomes part of the network, through the mining process, which you may have heard about. It is this mining that will verify the transactions and added to the blockchain ledger and update the amount of coins in circulation.

When someone solves the transaction and manages to validate the block, they receive a reward – the other people in the network also get to confirm that the result is correct.

The purpose of this validation process is to create a consensus in the network, this is what the Proof of Work was created for. In other words, PoW exists so that the blockchain network knows that the transaction is authentic and valid, and that no one malicious person wants to do something bad, such as spending the funds twice.

Without going into too much technical detail, PoW is based on Cryptography, a science that uses advanced mathematics to hide information behind an encryption. We’ll talk more about cryptography in the point below.

That’s why cryptocurrencies have that name, get it?

But attaching a new block is not a cheap process, in terms of computing resources. In order to complete the PoW, mining a new block and irreversibly attaching it to the network, securely and authentically, super-complex mathematical equations have to be solved by very advanced computers.

Some of the more recent blockchains of other cryptocurrencies have started using Proof of Stake (PoS) instead of Proof of Work (PoW). Both are mechanisms for validating transactions, without the need for control by a third party. But the absurd consumptions of electricity and computing power that PoW requires, along with the limited number of transactions per second that it enables, mean that many are advocating PoS as the ideal mechanism.

Among others, there is much talk that the Ethereum coin will move away from PoW and adopt PoS.

Cryptography, the Cherry on Top of the Security Cake

All this would be for nothing if all the data that is publicly accessible were in an alphanumeric format that everyone could read, right? Malicious people could alter this information. That’s why to close this batch on security let’s talk a bit about cryptography.

Miners and their supercomputers will validate all transactions and attach them to the blockchain, solving the demanding mathematical problems that a normal computer of today would take hundreds of years to solve. And knowing that Bitcoin’s limit is 21 million, each time these mathematical problems are more complicated to solve.

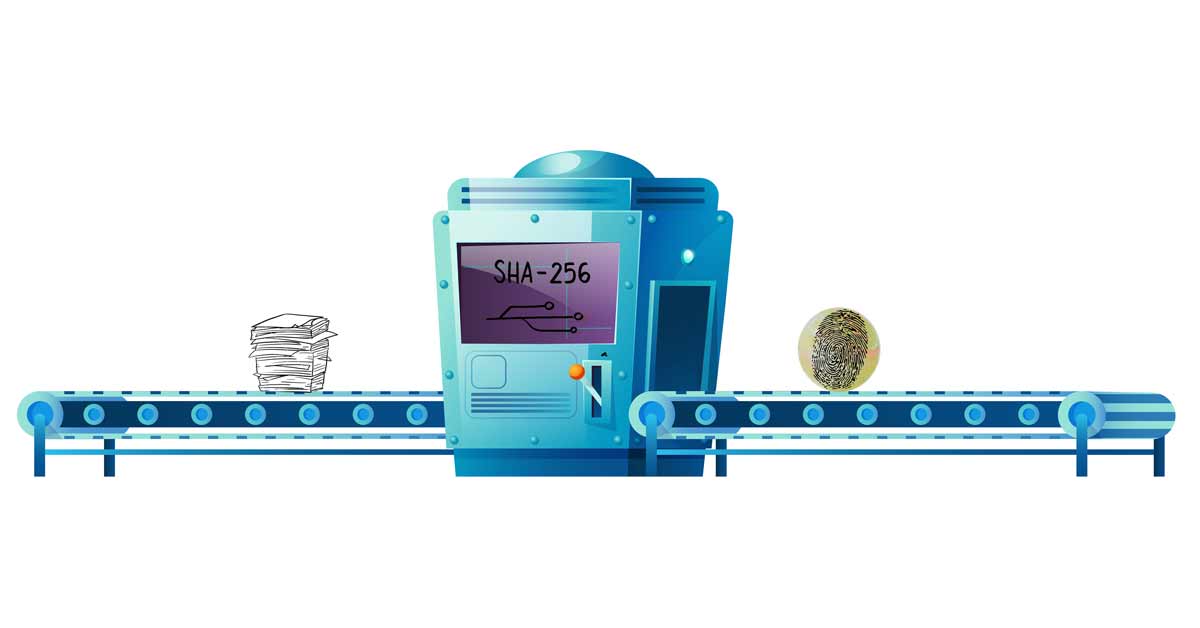

While this process goes on, another process runs in the background, called hashing. The hash of a block acts as a fingerprint, a unique, unrepeatable identity unique to each block. Through encryption, the piece of information is transformed into something unreadable (an alphanumeric sequence) using the SHA256 algorithm. Only the legitimate recipient with the right key can decrypt the piece of information.

If you are wondering how hard it is to “guess” the right hash, the chances of this happening are 1 in 115 quadratrorvigintillion, i.e. a number with 78 digits, so good luck! And yet, if you’re still not totally convinced about the security of SHA256, do yourself a favor and watch this video.

Connection between Blockchain and Bitcoin

We already know that blockchain is the technology that enables Bitcoin and the overwhelming majority of current cryptocurrencies to exist.

Bitcoin’s protocol is built on top of blockchain. In other words, Bitcoin’s vehicle is the blockchain.

And it is even true that Bitcoin took the blockchain idea and put it to real use for the first time. But, however, Bitcoin could end tomorrow, that the blockchain would continue to exist, even in various other projects outside the cryptocurrency sphere.

Today, there are other cryptos with their own version of blockchain, with different architectures and rules.

Case Studies in Blockchain Use

The finance sector is the one that has benefited the most from the constant implementation of blockchain, and will probably be the one that will have the greatest advantages in doing so. But beyond this, other areas are beginning to adopt it for its advantages. Giants such as Walmart, IBM, Siemens, Pfizer, among others, are already making use of the security, agility, and transparency associated with this technology. Noteworthy is the Food Trust blockchain developed by IBM, which allows a precise tracking of food products, from their origin to their commercial surface.

In healthcare, blockchain has begun to be used to keep patients’ medical records private and secure, but accessible to all who have a duty to consult them.

Also, in elections, a much-discussed topic in recent years due to rumors of vote manipulation, blockchain promises to lend a helping hand. It could facilitate the creation of a modern voting system, eliminating intermediaries from the process and voter fraud. The possible result would be a more transparent election, faster in issuing results, and more cost-efficient by the need for less manpower.

Thanks to this technology, a lot of dApps have started to appear, which are decentralized applications that allow the existence of digital wallets, exchanges, video games, among others. There are many and in different formats, but they have one thing in common. They all run on a decentralized, open-source peer-to-peer network and operate autonomously, independently of central authorities. Many of them create their own ecosystems and small parallel economies. There are many good examples, of which the video game Alien Worlds stands out.

The “Dark” Side of Blockchain and its Disadvantages

Like virtually all inventions and innovations, there is the side of disadvantages, challenges and misuses that has to be referred to, and blockchain is no exception to the rule.

Cost:

We can start with how costly this technology is. From the direct cost in adopting and applying blockchain to an existing structure, to the mining process, we are talking about very large amounts of money. The value associated with creating custom software and adapting it to an existing reality and business model requires hours and hours (read thousands of dollars) of programming, integration, design, etc. And the Proof of Work system that I described in the lines above, maintained by supercomputers, consumes absurd amounts of energy. To give you an idea, the Bitcoin network worldwide consumes the same as what a country like Denmark consumes annually in energy.

Illegal Activities:

The confidentiality of data is one of the most applauded aspects of this technology, but unfortunately it also attracts those who intend to carry out illegal activities. Perhaps the best example of this was the silk road site that existed on the ‘dark web’, where drug sales took place from 2011 to 2013, before it was shut down by the FBI. Purchases were made without being able to trace the buyer, with payments made in Bitcoin and other cryptos.

Regulation:

On a political and regulatory level there are also many obstacles and challenges. While adoption has made great strides, as with PayPal accepting the use of some cryptocurrencies, there are still many powerful people in the digital currency space who are against or show concerns in the face of lack of government regulation.

Blockchain and Its Many Advantages

But the advantages of blockchain are many, and we have already talked about several. Since our focus is on the network on which Bitcoin sits, let’s look at and review some of them from the point of view of this cryptocurrency:

Accuracy and Reliability of Blockchain Data:

The network’s transactions are approved and maintained by thousands of nodes that make up the network. This makes human involvement virtually nonexistent and removes any possible human errors – purposeful or otherwise – from the process. Self-auditing is constant and a node with an error quickly adjusts itself. The error could only spread in the chance of an attack on 51% of the rest of the network, a mission impossible given the size and speed at which Bitcoin’s network is growing.

Decentralization:

Information is not centralized in a single place, or set of places, whether physical or digital, that a person or entity belongs to. Instead they are copied and spread across a huge network of computers. Whenever a new block enters the network, the entire network of nodes is updated with the new information.

Fast and efficient transactions:

When there is a central authority, it is normal for your monetary transactions to take 1 or more days to execute. Who has never had to wait 2 or 3 days to have a check deposited? What about a transfer on Friday afternoon that doesn’t come in until Monday? Talk about overseas transfers then it can be a nightmare… blokchain works 365 days a year, 24 hours a day. There are no holidays, weekends or geographical areas getting in the way. In as little as 10 minutes you can have your funds and the transfer is considered safe and reliable within hours.

Transparency:

Most blockchains, namely cryptocurrencies, run open-source software. This means that anyone who wishes can see their base code. For those with the auditing function, everything is open and transparent. Also your transaction history is complete and publicly visible.

Secure Transactions:

We already explained that transactions are verified by the network of thousands of computers. After validation it is added to the blockchain. Each block comprises of its own unique hash, along with the unique hash of the previous block.

“Banking” the unbanked:

It may come as a surprise to you, but did you know that there are almost 2 billion adults in the world who have no bank accounts or way to keep their money safe? That’s the official data from the World Bank.

These people often earn little and are paid in cash. So, it becomes necessary to keep that physical cash somewhere, either in their homes or hiding places, leaving them at the mercy of theft and violence. Access to a vital Bitcoin wallet can be stored in any basic cell phone, memorized, or even kept on a simple piece of paper, although this is not ideal! Either way, it ends up being better than keeping your wads of cash under the mattress.

Conclusion

Blockchain already “existed” in theory, but it was Bitcoin that, in 2009, made it see the light of day. In just a decade, blockchain technology has grown immensely, matured, and is being adopted in new projects at a very rapid pace. Whether it is in the hundreds of other crypto that exist, or in various other areas, the potential associated with blockchain is impossible to unravel at present.

No one can say for sure whether Bitcoin will be in active circulation for 50 years from now, but few doubt that blockchain will be here, continuing its technological revolution in search of making our lives easier.