Staking in cryptocurrency is becoming very common. Let’s explain what it is, its advantages and differences to similar terms.

Staking in Cryptocurrency: what is it?

For sure you have heard of it, but maybe you still don’t know exactly what the process of staking in cryptocurrency is.

Along with staking come other terms such as farming or liquidity pools. All of them allow the trader to earn extra income from his or her cryptocurrencies.

When you are staking, you are setting aside your cryptocurrencies that you have in your wallet for a reward, earning a passive income.

If you want a comparison with the traditional financial system think about the following: you reserve your money in your bank in some financial product. Your bank will give you a (small) percentage profit in the future, right?

At the end of the duration of the financial product, your invested money comes back to your account, plus some profit.

Staking in cryptocurrency follows this idea, generally speaking.

But why do I gain by having my coins placed there?

That is an excellent question. Actually, your coins are not just sitting there doing nothing.

In staking, they will be set aside to perform a very important task of the blockchain network they belong to: validating network transactions.

It is because you put your cryptocurrencies to do an essential supporting activity that you receive rewards, doing this validation of the transactions.

Rest assured that by staking cryptocurrencies, you will not lose your coins. The platform where you staking is not investing or trading with them.

How Does Staking Work?

Blockchains rely on mechanisms to add and verify added blocks.

In order not to use third party systems when creating money (such as banks), it was necessary to develop what we call decentralized consensus mechanisms.

Such mechanisms serve to confirm that transactions exist, that they are true, that they are not duplicates, etc.

They are so important that without them, today’s blockchains would not exist.

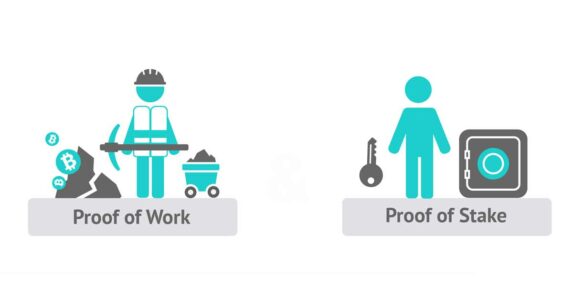

There are several, with their specific characteristics for each network. The two most important ones today are:

- Proof of Work (PoW): they rely on mining to add new blocks to the blockchain. Bitcoin (BTC) and Ethereum (ETH) still use this model.

- Proof of Stake (PoS): produce and validate new blocks through the process of staking. Coins like Cardano (ADA), Polygon (MATIC) and Polkadot (DOT) use this model.

This is why staking is only possible on blockchains that use PoS as a consensus mechanism.

And because the network needs and trusts validations made by the traders doing staking, the trader ends up being rewarded.

STAKING EXAMPLE OF A TOKEN: pulsemoon token.

This token is one of the best staking examples today. We get 3% daily. And since we can reclaim the rewards and restake them, it means that in about a month we can double the amount of tokens.

To buy the tokens you need to go here: https://www.pulsemoon.io/ and you can buy it in PancakeSwap an Decentralized Exchange.

Then, you need to connect you wallet (Metamask or Trust Wallet) and stake the Pulsemoon tokens here: STAKE_PLATFORM

Staking in cryptocurrency: how to?

Do you like the idea and want to do it? Very well, but the way in which it is done depends on your wallet/exchange platform. Please note that it is not possible to stake on all platforms.

You can do it on Binance, Coinbase, Bitfinex, PancakeSwap, among others.

Although the risk is low, always choose a trusted platform for staking.

As a general rule, if you see unknown platforms offering values that seem too good to be true, be suspicious and think very carefully before staking cryptocurrencies there.

Staking in Cryptocurrency on Binance

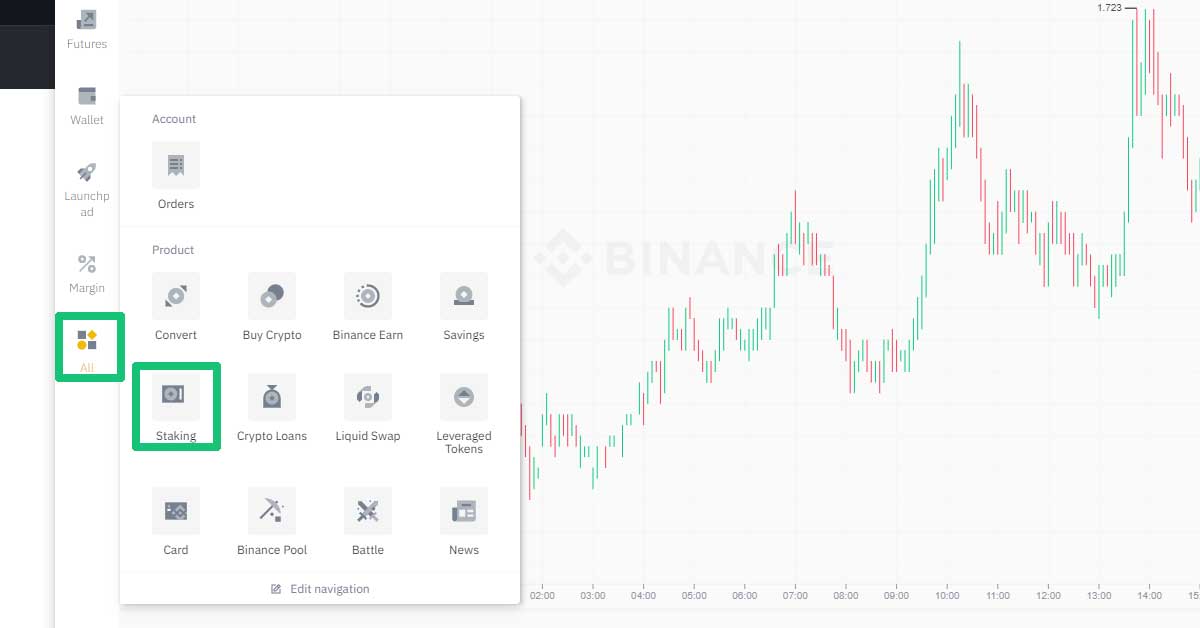

Inside your Binance go to the staking menu.

A new window will open and you can then set up your staking in cryptocurrencies that are available.

You can use either fixed staking or DeFi staking.

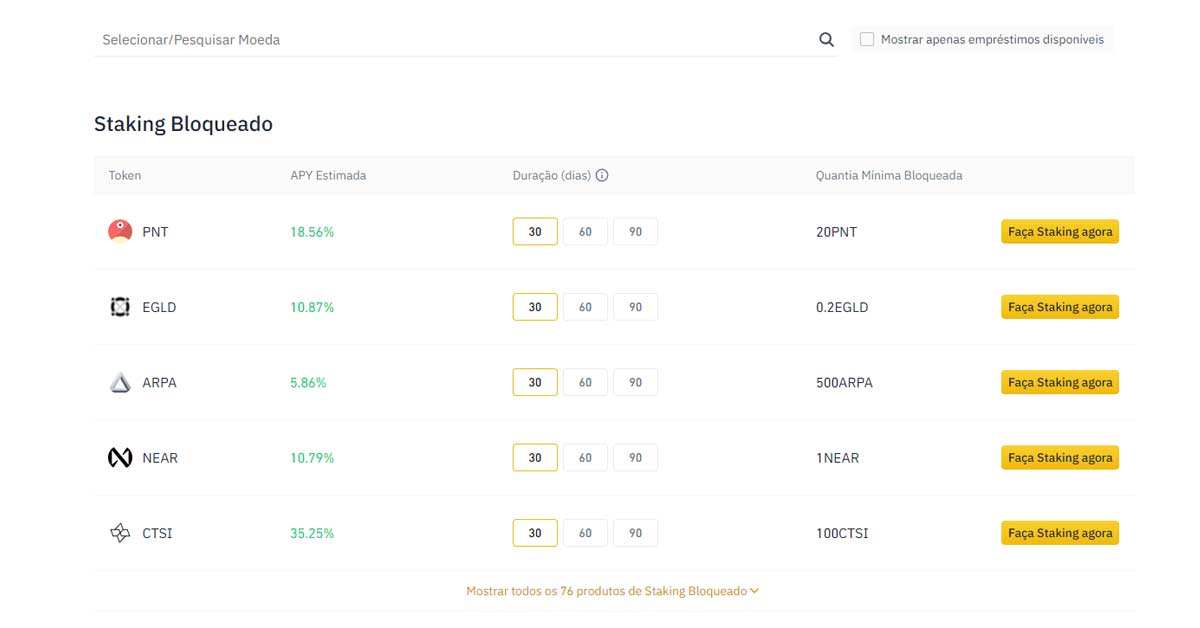

Let’s talk about fixed staking.

As you see in the image below you will have the various products available and your Annual Percentage Yield (APY) which means estimated percentage you will receive per year.

You have to choose the duration of your staking which can be 30, 60 or 90 days. During the defined term, the amount you allocate will be locked in.

Have no fear that you can make an early withdrawal, should you need your money. By opting for early withdrawal, the principal amount invested will be returned to the Spot account almost immediately.

As for interest, it will be deducted from the principal amount repaid. Due to different time zones, the receipt of tokens resulting from interest may take 48 to 72 hours.

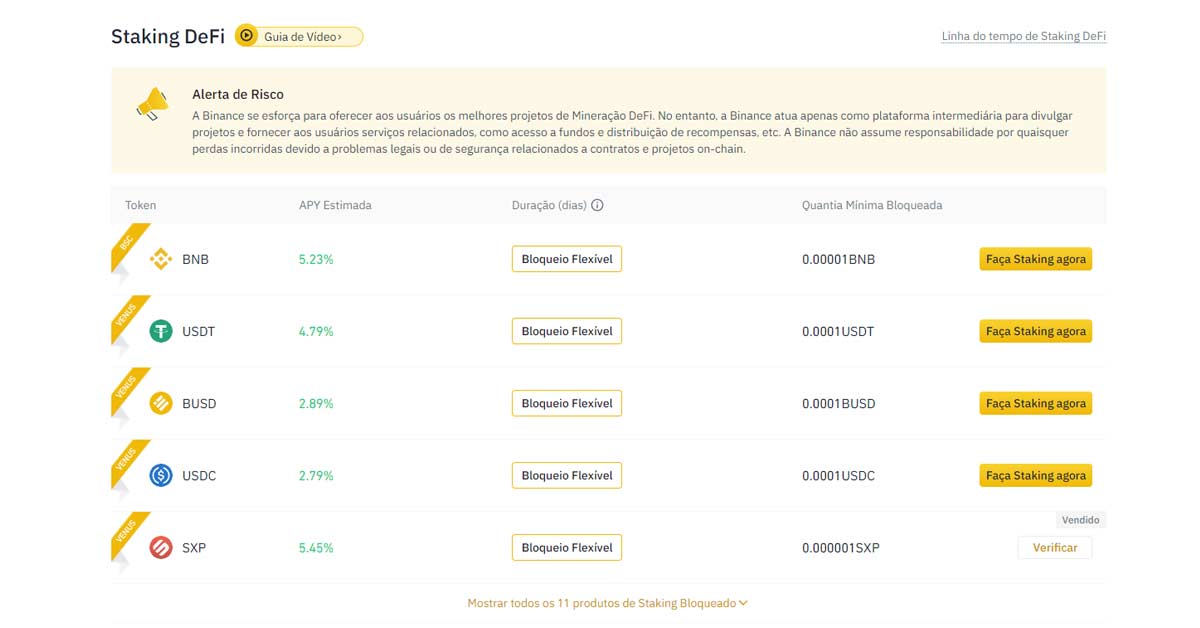

Defi staking is a little different. It allows the investor to access financial services to users through smart contracts. DeFi projects can give you higher annualized yields for specific currencies.

But as almost always, for higher yield, higher risk.

And Binance is very specific in saying that it does not bear the losses of a contract if it is targeted during the course of its DeFi staking.

The great advantage of this feature is that it is very simple to do, and Binance usually chooses safe projects with good profitability at very low rates.

But it is important to read very carefully all the conditions and information about the DeFi project at hand.

Binance Farming

There is yet another way to staking cryptocurrencies at Binance, but it has a different working model.

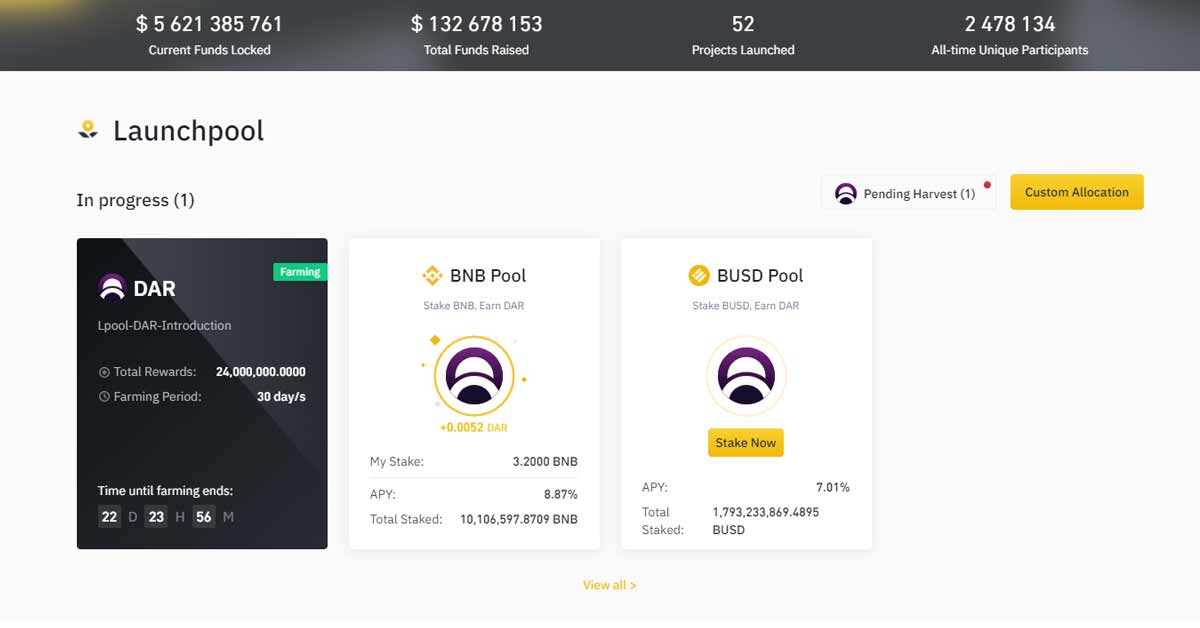

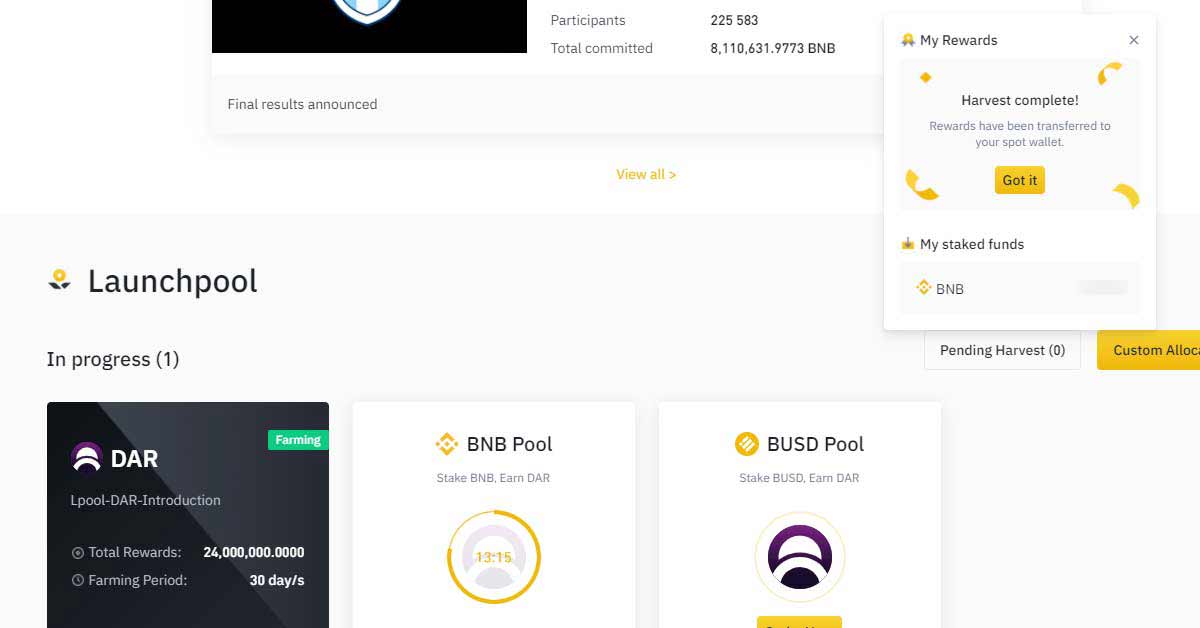

In Binance Launchpad you will staking your coins and make a passive, risk-free profit associated with it. It is flexible, since you can invest as much as you want and stop whenever you want.

In doing so, you are not helping the blockchain confirm transactions, as we explained in the previous point. But it is supporting the new projects that Binance chooses to support.

Besides Staking, a new form of increase your tokens for FREE is the Reflection.

In this post we explain what is Reflection and how it works.

Since 2019, Binance has been going for new projects that want to take off. Solid projects that will help the community in some way. Binance gives mentorship and expertise and opens doors to its community with millions of users willing to invest.

The projects then get giant exposure. To date there have been 53 projects founded, some of them today are true success stories like Axie Infinity (AXS) or Wing Finance (WING).

Here you will book and set aside your currencies (usually BNB and BUSD).

And over a period of 30 days you will “farm” (earn) tokens affecting to the project. The minimum to join is only 0.1 and there is no maximum cap. You will receive the new tokens according to the amount you allocate, i.e. the more you put aside, the more tokens you will earn.

To do this, it is very simple:

- Go to the Launchpool page.

- Select the asset in which you want to stake.

- Enter the amount of the token you wish to stake.

- Click on “Stake”.

- Done!

During the farming period, you can stop and have your tokens available immediately. You can also allocate a larger amount during this period.

- Earn new tokens with zero cost and zero risk

- Have access to new tokens even before they are released on the market

- Directly support projects that you think have potential to increase in value

How to stake in cryptocurrency on PancakeSwap

PancakeSwap is another platform that allows you to earn passive income while farming. They are a decentralized exchange that runs on the Binance Smart Chain.

In this model, you will also support some decentralized DeFi product by separating your coins, and allocating them to yield.

What the platforms will do is take your coins, add them to other traders’ coins in what is called a liquidity pool, or liquidity reserve. This “pool” will serve several purposes, which vary as needed.

Among other things, when someone wants to buy CAKE, they will seek them out from this pool of CAKE liquidity. That’s why, for these systems to exist, some user has to be provisioning liquidity. And for doing that work the user gets something in return.

Going back to PancakeSwap, the trader can earn the CAKE token, which serves as liquidity provisioning on the platform.

There are two, slightly different, ways to earn passively on PancakeSwap.

You can participate in a Farm, or you can participate in a Syrup Pool.

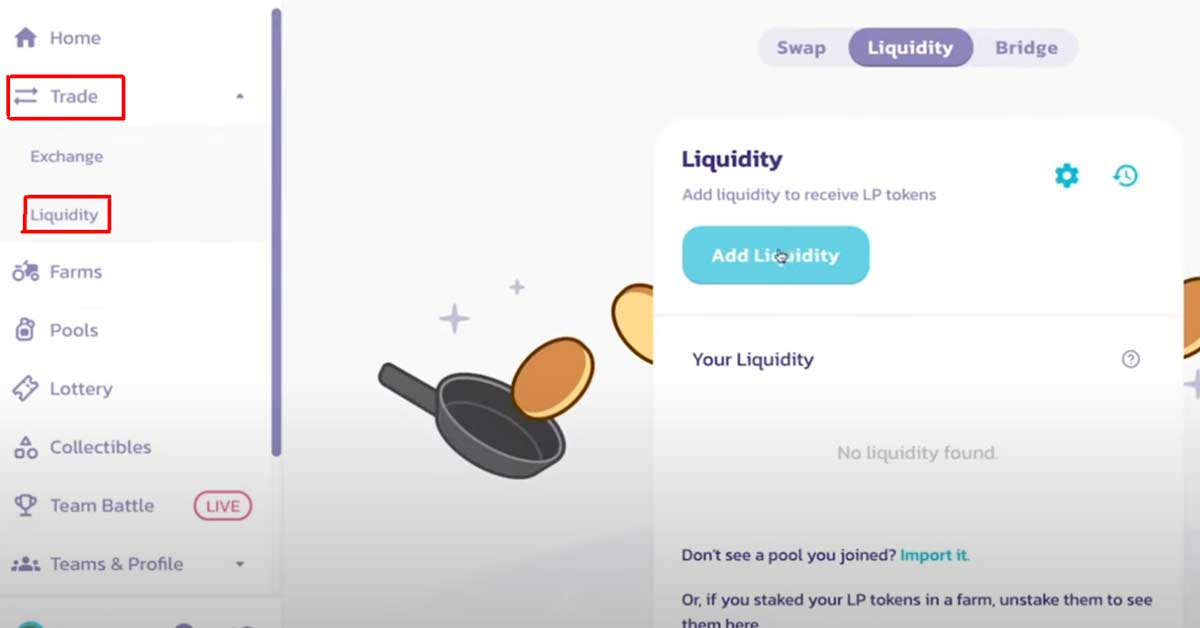

To participate in a farm, how to do it?

1 – go to trade, liquidity. Load “add liquidity”.

Let’s proceed with the CAKE-BNB pair. Choose the amount you want to allocate and click “supply” and then “confirm supply”. Then open your metamask, where it will show you the transaction data and do “confirm”.

The transaction is submitted and you now have a value in LP tokens, which are the required liquidity provider tokens. Now you are a liquidity provider, congratulations!

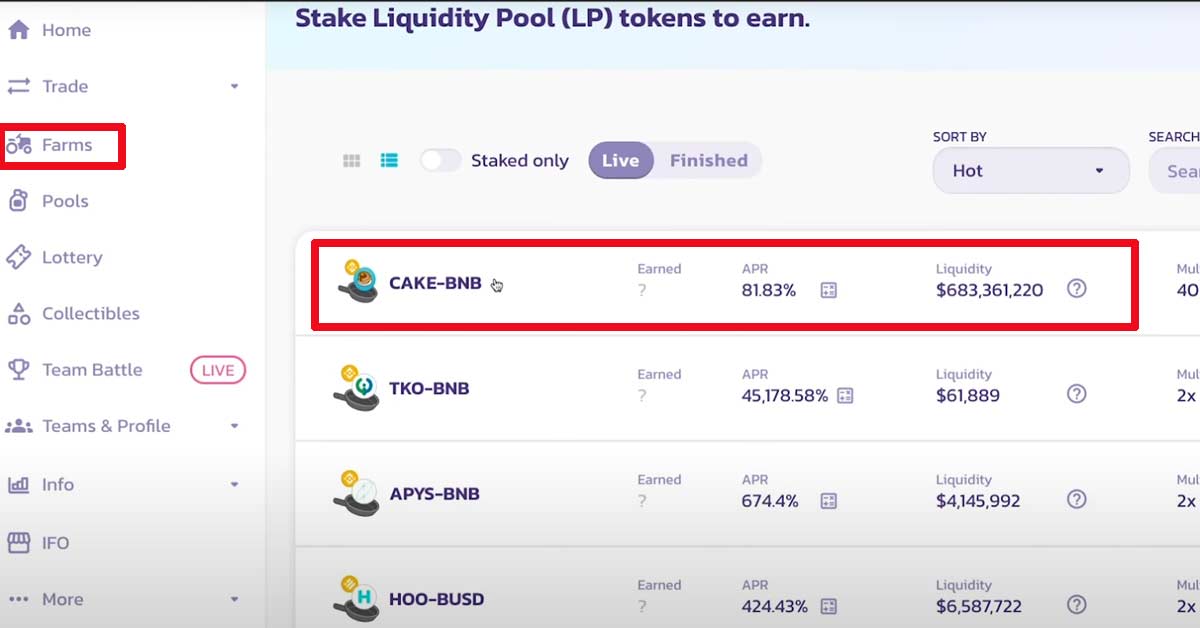

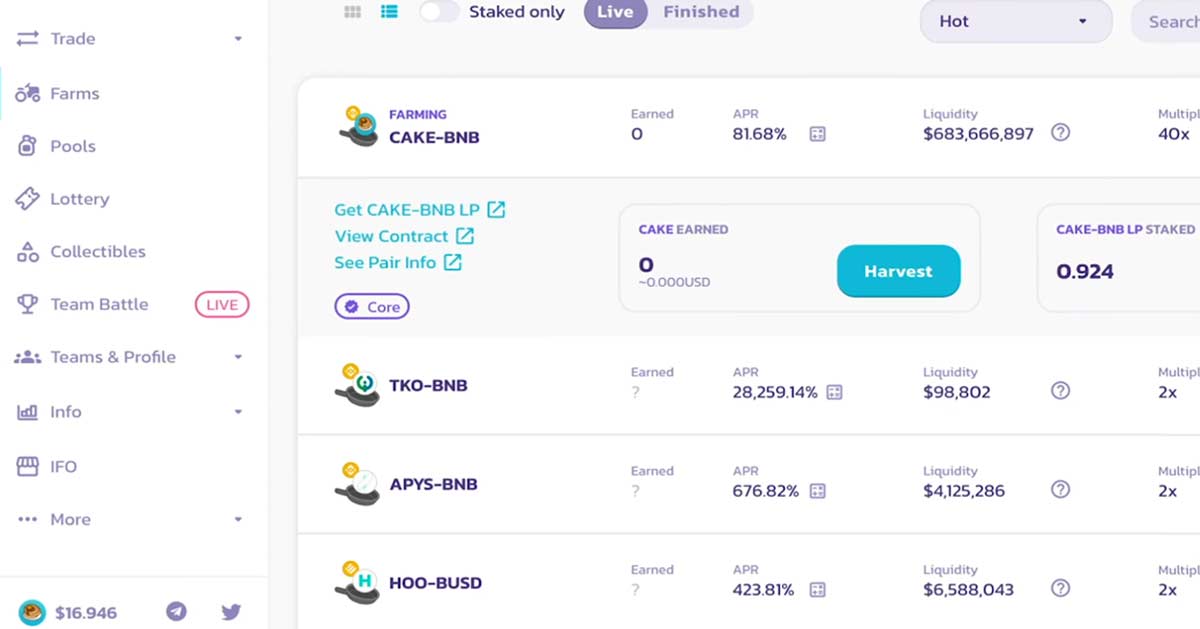

Now with the LP tokens go to the Farm page, choose the equivalent of your tokens, which in the case of the example are CAKE/BNB. The image shows which farm you can enter.

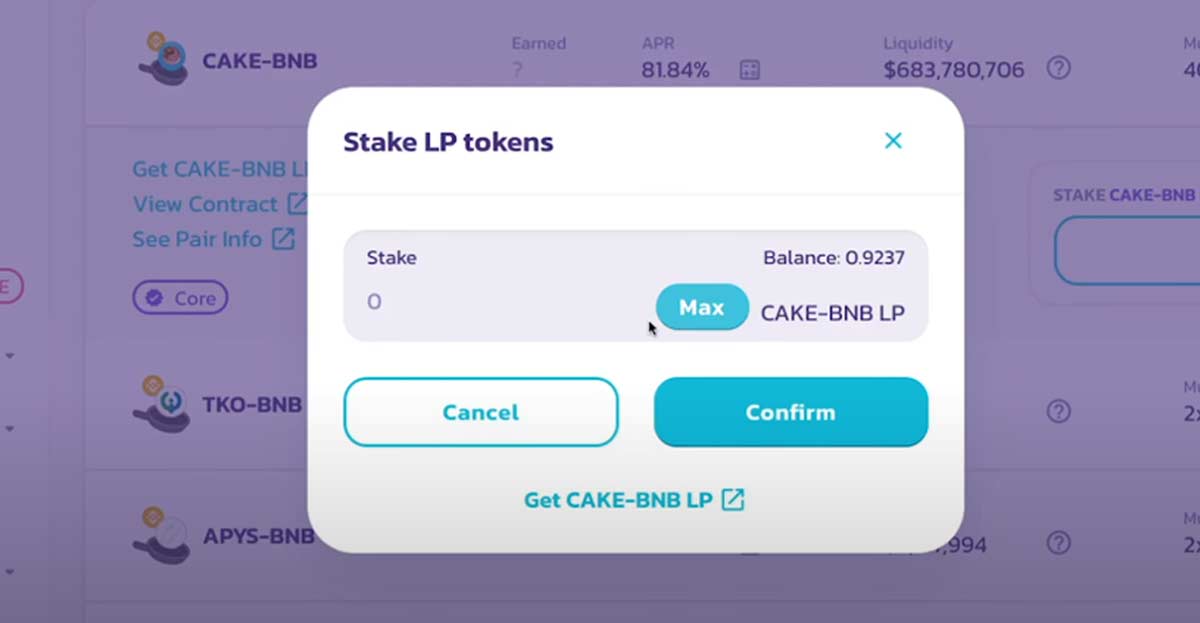

Clicking on this farm brings up a menu, where you can click on “stake LP”.

Then you can click on “max” to allocate all LP tokens, confirm with your metamask and you are done. Don’t forget you will always have small fees to pay.

Now, inside the farm menu you will have the image below, where you can see how many LP tokens you have and the button to “harvest”.

In a few hours, you should already see some value accumulated. Clicking “harvest” will automatically transfer the CAKE you have earned to your metamask.

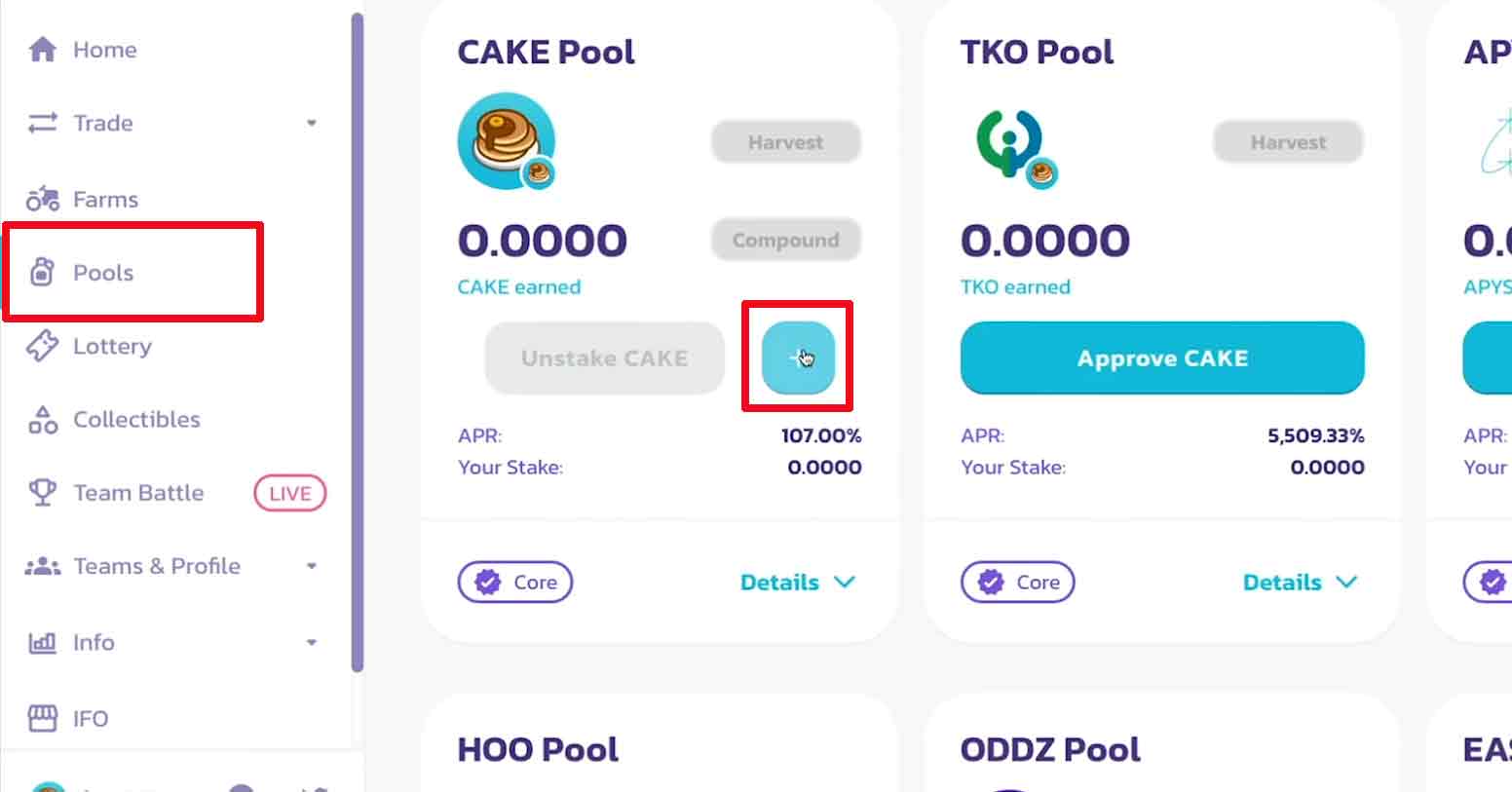

How can I participate in a Syrup Pool?

If you want to participate, you have to do the steps I explained so far. This step is optional, you only do it if you want to take your staking further, by staking the CAKE you have already won to earn even more CAKE or other tokens.

To access it, click as the image explains. You will have to click on the “+” sign, to allocate your CAKE. Choose the amount you want to stake and click “confirm”. Again, you will have to confirm in metamask.

This will use your CAKE, to generate more CAKE. So sweet, isn’t it!

You can unstake when you wish, by redeeming the coins. Just click on “Unstake CAKE”. Of course, you will always have to pay small fees, so there is no point in making stake and unstake every day.

Likewise, you can stop being a liquidity provider by redeeming LP tokens the same way.

Overall, farming can give better rewards than Syrup Pool, but it comes with an added risk of impermanent loss, which we explain below.

What is Impermanent Loss?

Providing liquidity to a liquidity pool can be a profitable venture, but you need to keep in mind the concept of impermanent loss.

The impermanent loss happens when the price of the currencies that make up the pair changes, relative to the value they had when you first deposited them. The greater the variation in price, the greater the loss.

Let’s take an example. This is purely illustrative, please don’t consider the actual values of the asset prices:

Jennifer deposits 100 ETH and 10,000 USD in a liquidity pool. The amount deposited must be in 50/50 format, i.e. 50% in ETH and 50% in USD. In the example, the equivalent value of 1 ETH is 100 USD at the time of the deposit. 1 ETH = 100 USD.

Therefore, the value of your deposit in dollars is 20,000 USD at that time.

As time passes, the value of ETH rises to 110 USD.

While this is happening, other traders will add USD to the pool and withdraw ETH, until the ratio is reflected in the current price.

This is how control is done on these so-called Automated Market Maker platforms, there is no order book. What determines the price of the assets in the pool is the ratio between them in the pool itself. The total liquidity in the pool remains the same, but the ratio of its assets changes.

Now Jennifer has in the pool 10,488 USD and 95,347 ETH (no longer 100 ETH).

We take the 95,347 ETH x 110 (current cost of ETH) = 10,488.

So we have 10,488 USD and 10,488 ETH, which gives a total of 20,976 USD.

Jennifer decides to stop being a liquidity provider and withdraw the funds.

So she will redeem 20,976 USD, which makes a profit of $976, pretty cool, right?

But, let’s look at market values and see how much she would have earned if she had simply held (the act of HOLD or HODL) those funds.

Her $10,000 remained the same, but with the movement of the ETH market, she would have the equivalent of $11,000 because the value of ETH went up, remember?

So instead of the profit she made of 20,976 USD in the example, she would have 21,000 USD, making 24 USD more, doing nothing, just holding (or hodling as some prefer).

In this example, and due to the impermanent loss, Jennifer ended up losing. It would have been more profitable not to have participated in the pool.

And as we always repeat, because crypto has a high volatility associated with it, it is very likely that the price of the asset will change, during its liquidity provision, suffering from the effect of impermanent loss.

Conclusion of Staking in Cryptocurrency

You now have a good amount of knowledge about the various passive ways to earn a good income by staking in cryptocurrency.

As a conclusion we will give you the main advantages of staking in cryptocurrency:

- allows you to generate passive income, in several cases up to 20% per year

- you don’t need to have equipment or hardware (which usually costs several hundred or thousands) with whom you do mining

- you are doing vital work for the network, keeping it safe and efficient

- it helps the network, but in a much greener way for the planet

- allows you to directly help your favorite DeFi or blockchain projects

But of course, it also has its number of risks that you have to watch out for:

- cryptocurrencies have great volatility. If your assets at stake suffer a big drop in price, this could nullify the ‘interest’ profit you might make, resulting in a loss in the long run.

- Staking in cryptocurrencies usually ‘forces’ you to set aside an amount for a minimum period of time. During this period of time you do not have access to these funds.

- In most cases you can easily redeem/withdraw the coins, but it can take some time, up to 1 week. During this time, if you urgently need the coins, you will not have them, and will have to wait.

Be attentive to all these details and think if and where you should be staking in cryptocurrency. But without a doubt this is a very interesting process for you to make an extra profit without much work and with little risk.

FAQs – Frequently Asked Questions about Staking in cryptocurrency

By leaving my crypto left in my wallet am I doing automatic staking?

No, you have to staking in a specific area within your portfolio for that purpose. There are a few coins that allow that automatic staking in cryptocurrency and that is called reflection. Although that is a different topic.

Why shouldn’t I be staking on “suspicious” platforms?

The platform may disappear out of the blue, causing your coins to disappear as well. Or they may simply suffer an attack from hackers, who can steal your crypto.

Does staking benefit those who have more coins?

Yes, in general, as explained in the article, the owners of more coins may have a higher return in the end

STAKING PLATFORM Get 7% Daily