Spot grid trading from Binance is a trading strategy that involves creating a grid of buy and sell orders around the current price of an asset.

The objective is to profit from the asset’s price movements, buying more when the price falls and selling when the price rises.

How does Binance spot grid trading work?

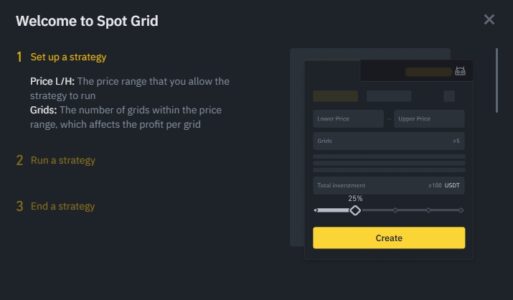

To set up spot grid trading on Binance, you choose the asset pair you want to trade and define the grid size (price gap between orders) and the number of orders you want to place on each side of the current price. Binance then automatically places the buy and sell orders within the grid.

When the price reaches a level where an order is executed, Binance automatically places new orders within the grid so that the trading strategy continues. This is an automated form of trading that can be used to try to make a profit in markets with high volatility. It is important to remember that this strategy involves risk and can result in significant losses.

What are the advantages of using spot grid trading from Binance?

Binance spot grid trading may have some advantages compared to other trading strategies, such as:

Automation: Spot grid trading is fully automated and managed by the Binance platform, which means there is no need to constantly monitor the market.

Risk control: With spot grid trading, it is possible to define price levels for buying and selling the asset, which allows you to better manage market risk.

Flexibility: Grid size and the number of orders can be customized to suit individual trading needs.

Low cost: Spot grid trading can have lower costs compared to other trading strategies like day trading.

Potential for profit: Spot grid trading can be a profitable strategy in volatile markets, allowing you to buy assets at lower prices and sell them at higher prices.

However, it is important to remember that spot grid trading also involves risks, as discussed earlier, and must be used with care and managed properly.

What are the risks of using Binance spot grid trading?

Binance spot grid trading, like any trading strategy, involves risk. Here are some of the main risks associated with this strategy:

Market risk: Spot grid trading is designed to profit from market volatility. However, if the market moves in an unexpected direction or remains stable, it can result in losses.

Execution risk: Orders within the grid may not be executed immediately, especially in markets with low liquidity, which can lead to losses.

Price risk: If the market price drops below the first grid order bid price, losses may result as the price continues to decline.

Cost risk: Trading involves fees, such as commissions and financing fees, which can reduce profits and increase losses.

Risk of technical failure: Technical problems, such as connection problems, may prevent orders from being executed and result in losses.

Therefore, it is important to understand the risks involved and manage them accordingly by setting loss limits and using the strategy sparingly. We advise users to gain a thorough understanding of the strategy and the risks involved before using it.

What is the best Binance spot grid trading strategy?

Here are some tips that can help you create a successful strategy:

Choose the right asset pair: It is important to choose an asset pair that has high liquidity and volatility to maximize profit opportunities.

Set an appropriate grid: It is important to set the grid according to market volatility and the level of risk you are willing to take. A grid with too small a gap can result in many executed orders and higher fees, while a grid that is too large can lead to bigger losses.

Manage risk: Set profit and loss limits and monitor the position regularly to ensure there are no excessive losses.

Keep fees in mind: It is important to consider trading and funding fees when creating a grid trading strategy.

Adjust the strategy as needed: The market is dynamic and the strategy must be adjusted according to current market conditions.

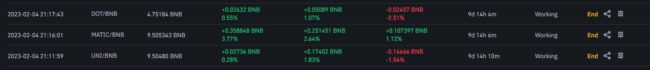

I have been using several strategies to test the system and the results have been very interesting, the 3 with the best results being the ones that use BNB as the base token, and 3 tokens that belong to 3 different blockchains as the tokens that pair with the BNB.

In this strategy, the idea was to find tokens that have potential and some similarity in the way they behave in the market with BNB, so there is some volatility between them, but not too much.

Another idea at the base of this strategy was not to use a stablecoin in the base so that if the market reacts to the rise, it does not only have the stable coin in its portfolio and does not take advantage of the rise.

If you are interested in knowing more about the strategy leave a comment below.

According to the figures so far, it is possible that over a year, profits with this strategy are greater than 50%, which for a strategy where leverage is not used is very good profit potential.

Also, the concern of not using leverage allows for greater risk control and the possibility of incurring fewer losses, compared to strategies that use leverage.

What are the differences between Binance spot grid trading and a trading robot?

Spot grid trading from Binance and a trading robot are two ways to automate cryptocurrency trading, but there are some significant differences between them. Here are some of the differences:

- Flexibility: Binance spot grid trading allows users to customize the grid size and the number of orders, whereas a trading robot is usually designed to follow a specific set of rules or strategies.

- Customization: With spot grid trading, users can adjust the strategy according to market conditions and their own risk tolerance. With a trading robot, the settings are usually more fixed and can be limited.

- Control: In spot grid trading, users retain full control over the position and can monitor it regularly. With a trading robot, the software executes trades without user intervention.

- Complexity: A trading robot may have a more complex strategy, such as advanced technical analysis and machine learning, while spot grid trading is a relatively simple strategy based on limit orders and price grids.

- Cost: A trading robot may require subscription fees or a license fee, while spot grid trading is free for Binance users.

In short, Binance spot grid trading is a trading strategy that can be automated but gives users more flexibility and control than a trading robot. However, a trading robot may have a more advanced strategy and may be better suited for users with more experience and knowledge of algorithmic trading.

Binance: Official Site