Economical News usually affects the daily activity of the main assets in your platform. It is time for you to know more about the strategy based on the news, so we prepared this article, don’t fall behind.

News Trading Strategy

News Trading Strategy or also called a fundamental strategy is a very old type of Strategy used in all other markets such as Forex or Stock Exchange.

For many traders, it is a simple and very practical way to trade and make significant profits.

Most Binary Options strategies are based on reading graphs and understanding some indicators such as the Stochastic, the RSI, Moving Averages or others, the News Trading Strategy teaches you to negotiate based on news.

That is, not having to use graphical analysis, but be attentive to the economic news that moves the market.

Many people do not have the required analytical skills, nor are they interested in learning how to use charts and indicators.

Some people question whether it is possible to trade Binary Options without this knowledge and without using the strategies that all websites teach and that are based on this knowledge of graphical or technical analysis.

The answer is yes. There is a very simple way of trading that does not require any kind of knowledge in technical analysis.

Advantages of News Trading Strategy:

- No knowledge of technical chart analysis required.

- You do not need to configure graphs with complex indicators.

- No need to spend hours waiting for an entrance.

- The news has a scheduled time, you only have to be ready when the news are released.

- The market usually always reacts the same way to the important economic news, so the hit rate is very good.

In addition to the strategy I explain below, we also have a news strategy module in our Online Training.

In this module, we explain the most important economic news and how to trade in each one.

It is a very simple, and understandable strategy.

Also, a great strategy to apply, whether for those who like to trade based on news or for those who operate with analytical strategies but wish to have a plan B.

Sometimes we offer this module, along with other offers for our partners (Binary Options Brokers).

Please ask our support if we have any offer campaigns for this active module, or check here if the PROMOTION IS ACTIVE.

News Trading Strategy

It is very simple. You just have to choose a site that has all the important news that makes the prices of the assets vary.

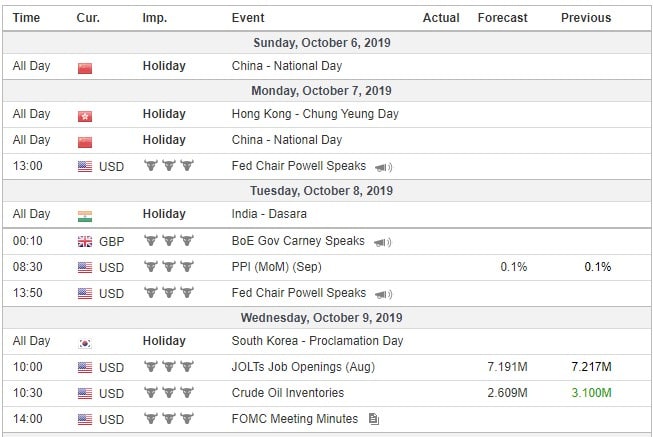

You can use the site Forex Factory or investing. The calendar has all events per day and an hour for the current week.

We just have to learn to apply the results simply to binary options trading. How to do it? It is very simple.

Example of Forex Factory Calendar

EXPLANATION OF THE NEWS TRADING STRATEGY:

1 – We should only look at high impact news (see the subtitles of the calendars).

2 – Then we need to understand which asset the news will affect. This website affects the assets on the foreign exchange market or Forex.

That is, we will trade binary options based on Forex assets. For example, a news story about the USD will affect pairs that have the USD: EUR/USD, GBP/USD, USD/CHF, etc.

If the news is from Europe, there are countries whose reports have greater impact than others. In the first place is Germany and then France.

We should only focus on the news for these two countries. And for pairs with the EUR, such as EUR/USD, EUR/GBP, EUR/CHF, etc.

3 – As an example, imagine that there is a high-impact (red) news report at 08:00 GMT for Germany.

On the Forex Factory website, there are 3 columns: the actual value (current value updated as the news is released), the forecast which is the prediction and the previous value, typically the last month.

4 – The news is released; it had a forecast of for example 10 but the actual result is 9.

This means that the value was below the forecast, which is bad for Germany, which will tend to cause the EUR to fall.

Let’s imagine, however, that the news was on unemployment. And that the forecast was 7% but the result was 6.9%, in this case being below is good, because unemployment fell.

In this situation, the EUR will rise.

The way to tell if the result is better or worse than expected is to look at the color of the value that just came out. If it is GREEN, it was better.

In this case, it was good for the EUR and it will go up. If it is RED, it was bad and the EUR will fall relative to other currencies.

Example of Investing Economic Calendar

5 – Summary. Choose important news (red icon).

Check if the result is above or below expectations and on that basis, trade the assets that are directly linked to this news. You don’t have to analyze anything else.

6 – For this News Trading Strategy to work it is important to act right at the moment the news is announced.

If the news is at 8:00 am you have to place the order right at the moment that the result comes out.

Please note that the greater the disparity between the forecast and the result, the more likely the price will be influenced by this news, therefore the more likely you are to make money.

7 – The kind of trade that you should use is the high/low and use an asset time-frame of between 5 to 15 minutes.

Because normally in the few minutes after the news announcement, the market will react to the news.

From my experience, the ones that work best are the 5 minutes and the 15 minutes.

However, the asset itself will vary the results. If, for example, you use the EUR/USD, you can use the 5-minute time-frame.

Precautions in using News Trading Strategy:

Sometimes before the news announcement, the market is volatile, making the price shoot in one direction, or go up and down quickly and with large variations.

If this happens, wait for the news and for the market to stabilize. After 1 minute, trade based on the result.

Sometimes there are several news announcements at the same time, some for Europe that affect the EUR and others for the US that affect the USD.

In this case, it is sometimes better not to trade, for example, if you want to trade the EUR/USD.

When the news is announced, you have to read the result and place the trade in the right direction.

For example: If there is news for the USD and it is good, and you trade the EUR/USD, the price will fall, because being good news for the United States makes the USD climb and the EUR drop which causes a lower price in EUR/USD.

Usually, when this News Trading Strategy is applied well, it can have a success rate of 70%, which means that in every 10 trades, you will be right on 7 and wrong on 3.

Most of the Brokers offers a gain of about 80% for the EUR/USD, which translates into a gain of 56 and a loss of 30 when using this News Trading Strategy.

The best way to get results is to test several assets with different time-frames (5, 10 or 15 minutes) and see which suits you best.

The advice that I always give is that if you have 3 bad negotiations, it is because you’re doing something wrong or it is a bad day for the News Trading Strategy.

Check everything that you’re doing and fix the mistakes.

If you’re not doing anything wrong with the news trading strategy then it’s because the market is not reacting logically to the news that is coming out.

In this case, you should turn off the platform and not trade anymore more during that day. Come back the next day.

If you like this strategy, check at all the other strategies on the site: Binary Options Strategies